REBALANCING WHEN TIMES ARE GOOD

Rebalancing is difficult when times are good or bad. Consider the experience of investors in the five-year period from October 2002 (the trough of the market) through October 2007.1 Normally, stock markets bottom out prior to the end of a recession. But in the recession following the NASDAQ collapse, stock markets were still falling when the recession ended in November 2001. It was only in October 2002 that markets finally reached bottom.

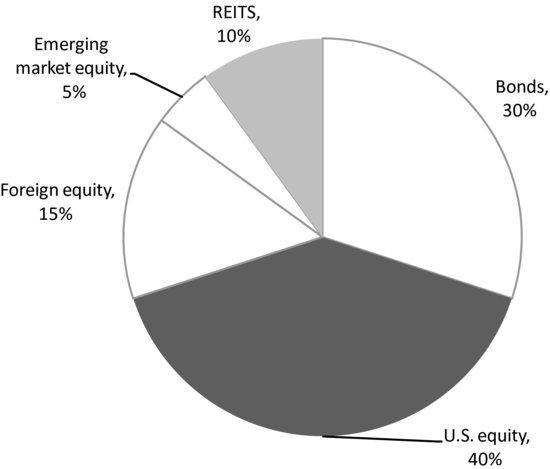

Suppose that in October 2002, an investor chose a portfolio with 30 percent invested in bonds and 70 percent in stocks. Let’s diversify the stock market investments so that we have 40 percent in U.S. stocks (represented by the Russell 3000 Index), 15 percent in the MSCI EAFE Index, 5 percent in MSCI Emerging Markets, and 10 percent in REITS. The bond investment is tracked using the Barclays Capital Aggregate Index. Figure 16.2 summarizes the allocation.

FIGURE 16.2 Diversified Portfolio in October 2002

Over the next five years, stock markets boomed. EAFE rose 189.8 percent while the MSCI EM index rose 443.9 percent and the FTSE NAREIT index rose 181.3 percent. Bonds, in contrast, limped along with a 24.1 percent total return over five years. An investor who never rebalanced would find that the portfolio had drifted to a much riskier allocation. Figure 16.3 shows the drift of this portfolio. Even though the investor ...

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.