REBALANCING WHEN TIMES ARE BAD

If it seems difficult to rebalance when markets are soaring, it is even more difficult to do so when markets are tumbling. Consider the experience of investors during the bust from October 2007 through March 2009.2 During that period, the S&P 500 fell by almost 47 percent as did the Russell 3000. Foreign stocks fell even more, EAFE by 53.6 percent and MSCI Emerging Markets by 55.9 percent. REITS topped them all by falling 63.4 percent.

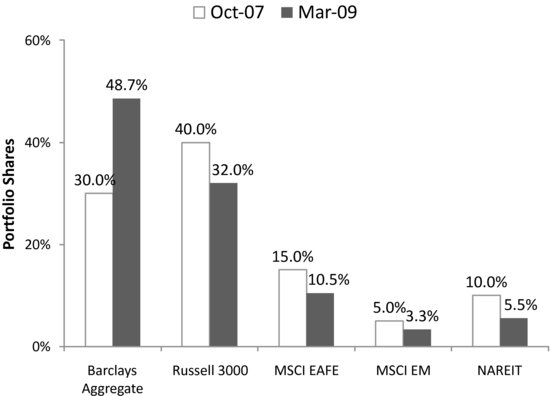

Figure 16.4 shows how these sharp losses distorted the asset allocation. The bond allocation drifted upward from 30 percent of the portfolio to 48.7 percent. The U.S. stock allocation plummeted by 8 percent, foreign stocks by 4.5 percent. REITS fell from 10 percent of the portfolio to 5.5 percent.

FIGURE 16.4 Drift of Portfolio Shares in Bust

Data Sources: Barclays Capital, Russell®, MSCI, and ©FTSE.

What should the investor have done in that bleak winter of 2008 and 2009? If the investor followed a disciplined approach to asset allocation, the portfolio should have been rebalanced at the trough or, perhaps more realistically, early in 2009 when annual returns were reported for 2008. But what tremendous discipline would have been required! The United States and the world as a whole had just gone through the worst financial crisis since the 1930s depression. Several major financial institutions had failed or had been ...

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.