HOLD TIME: HOW LONG IS LONG ENOUGH?

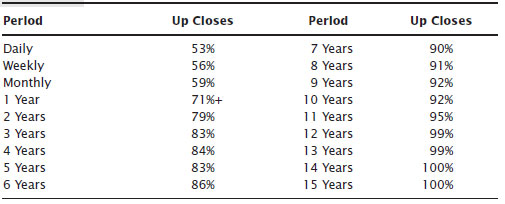

I read in a magazine that as holding time increases, the more likely it is that a trade makes money. Is that why day traders have such difficulty making money? I decided to look at the S&P 500 index from January 1950 to April 2010 and counted the number of overlapping periods in which the index closed higher from period to period. Table 2.4 shows the results.

Table 2.4 Number of Times the S&P 500 Index Closed Higher

For example, over the 50+ years, the index closed higher 53 percent of the time on a day-to-day basis, excluding commissions, slippage, and other expenses. If you bought the index at the close of each day and held for a day, you would make a profit 53 percent of the time. If you bought at the end of each month and held for a month, you would make money 59 percent of the time.

Let us take another example to show how I computed the numbers. If you bought the index and held it for 10 years, you would have made money 92 percent of the time.

I used monthly overlapping closes in the analysis. By that, I mean if you bought in January, you would sell 10 years later, in December. Then I computed the February to January holding period with 10 years between them, and so on, each month beginning a new 10-year holding period. That is what I mean by overlapping periods. All of the rows in Table 2.4 have monthly overlapping periods except daily, ...

Get Trading Basics: Evolution of a Trader now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.