AVERAGING DOWN: THROWING AWAY MONEY OR SMART CHOICE?

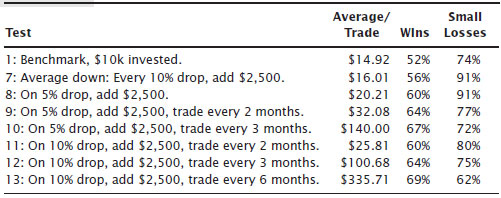

I wanted to explore averaging down so I conducted additional tests that Table 2.10 shows. Averaging down means buying more stock at a lower price to drop the average cost of the shares.

Table 2.10 Averaging Down Tests

Test 1 is the benchmark discussed in Table 2.9 and is repeated here for reference.

Test 7

Divide the initial $10,000 into four lots of $2,500. Each time the stock drops 10 percent, buy another $2,500 until spending the full $10,000. No stop loss order was used.

As Table 2.10 shows, this test yielded a profit of $16.01, beating buy-and-hold. However, the number of small losses dropped to 91 percent. Just 2 percent of the trades invested the full $10,000, meaning most stocks did not suffer huge drops during the monthly test. Risk begins at $250 and increases by $250 until it hits $1,000. The number of winning trades increased to 56 percent.

Notice that this is the first test with profits that beat buy-and-hold. The results suggest that averaging down cuts risk and increases profits, at least in this test. Also notice that we are not adding the full $10,000 each time the stock drops. Rather, the test splits the $10,000 into equal lots of $2,500 and invests that.

Tests 8 to 10

Since drops of 10 percent in a stock over the course of a month seldom occur, I changed the prior test to average down if the stock drops 5 percent ...

Get Trading Basics: Evolution of a Trader now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.