The Smoot-Hawley Act: The Mother of All Congressional Effects

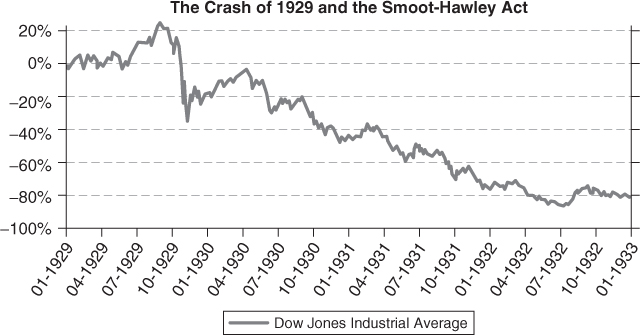

At this point, I decided to look at the biggest historical legislative event—the Smoot-Hawley Tariff Act of 1930—to see if it had a Congressional Effect. This law sharply raised the most important tax of the day—tariffs—and is widely credited as the single most important cause of the Great Depression and the stock market crash associated with it. From its historic high of 384 in October 1929, the Dow Jones Industrial Average fell to a low of 41 in July 1932. President Hoover had campaigned on a platform of raising tariffs for farmers, and the Republicans controlled Congress as well as the presidency. The law was first presented to the House on May 9, 1929, when the Dow Jones Average had closed at 323.51 the day before. The House vote for it occurred on May 28, 1929, and the Dow closed at 298.87, a decline of 9.24 percent while the legislation was considered. However, there is little evidence that the stock market reacted harshly to the bill, and it went on to make new highs in September. The timeline of the Smoot-Hawley Act and the stock market is shown in Figure 1.4.

In “Log-Rolling and Economic Interests in the Passage of the Smoot-Hawley Tariff” (NBER Working Paper No. 5510, 1996), Douglas Irwin and Randall Kroszner show that the severity of ...

Get Trade the Congressional Effect: How To Profit from Congress's Impact on the Stock Market now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.