THREE-WAVE STRUCTURES

In a three-wave structure, the waves are called A, B, and C. Corrections are always counted as A-B-C. The three-wave structure, A-B-C, corrects the movement of the five-wave structure. Wave B retraces the movement of Wave A.

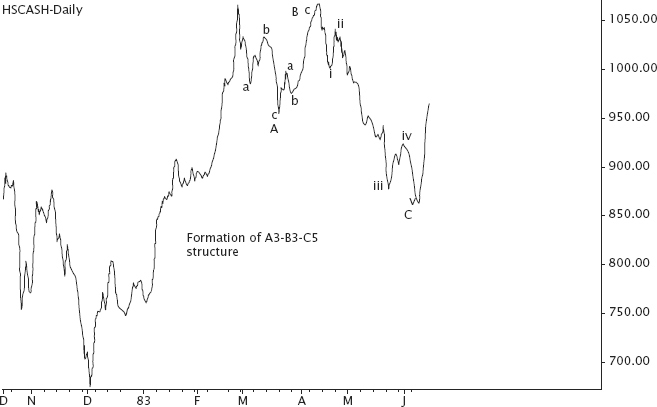

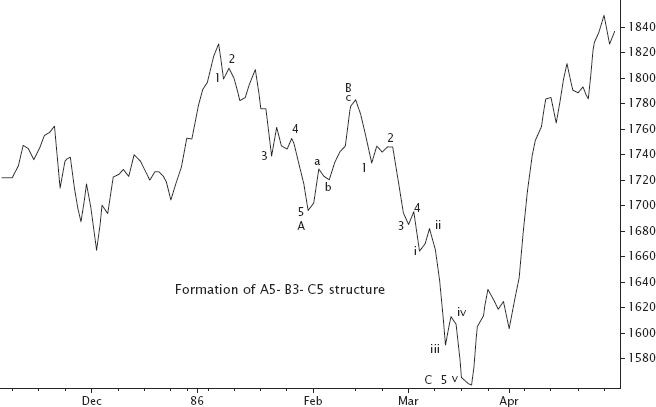

Price movements in a three-wave structure can be further subdivided into smaller waves. Wave A can be subdivided into five-wave movements or three-wave movements. Wave B can only be subdivided into three waves and Wave C can only be subdivided into five wave movements or a diagonal triangle pattern. The formation of an A-B-C correction will therefore consist of two main patterns: A3-B3-C5 or A5-B3-C5 (see Figure 4.9 and Figure 4.10).

FIGURE 4.9 Formation of an A-B-C correction (A3-B3-C5) after a five-wave pattern.

FIGURE 4.10 Formation of an A-B-C correction (A5-B3-C5) with extended Wave 5 in Wave C.

Wave A is the first corrective movement of an A-B-C correction. If Wave A is subdivided into a three-wave structure, then it signals the beginning of an A3-B3-C5 corrective formation. Generally, in an A3-B3-C5 formation, Wave B should do one of the following:

- Retrace approximately the entire Wave A in the case of a normal flat.

- Retrace approximately 61.8 percent of Wave A if Wave B is a failure.

- Retrace beyond the beginning of Wave A by ...

Get Timing Solutions for Swing Traders: A Novel Approach to Successful Trading Using Technical Analysis and Financial Astrology now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.