Illiquidity and the J-Curve Effect

Investors in private equity should have a long investment time horizon, as returns on commitments do not materialize for years and the penalty for abandoning a commitment is severe. Most fund partnerships have a 12-year life with the possibility of one or two one-year extensions thereafter.

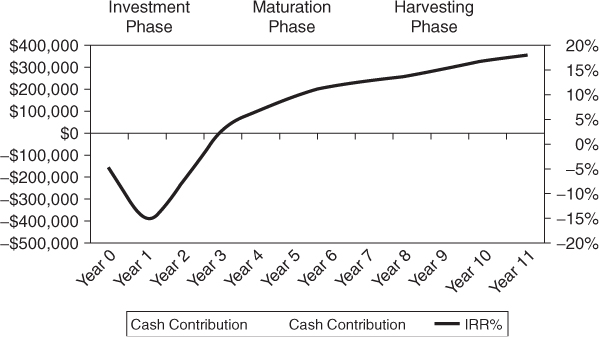

On top of the illiquidity, PE investors must be willing to navigate the dreaded J-curve effect: Returns in the early years are almost always negative.

This phenomenon referred to as the J-curve can be illustrated graphically, as shown in Figure 16.1.

Investors who are new to PE are often horrified by the sudden drop in value of their investment, but the J-curve is almost inevitable. It occurs for a number of reasons, but the primary ones are these:

- Organizational expenses of private equity partnerships are deducted immediately, so no sooner does an investor meet the first capital call than the return immediately turns negative.9

- Smart general partners will identify bad investments quickly and write them down or off, whereas good investments will take time to pay off.

- Most of the better PE firms follow very conservative policies when writing investments up or down: Bad developments cause immediate write-downs, but happy developments don't result in write-ups until some event occurs confirming ...

Get The Stewardship of Wealth: Successful Private Wealth Management for Investors and Their Advisors, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.