Traditional Asset Allocation Modeling

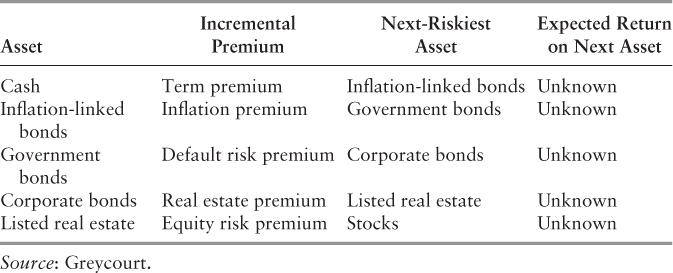

Financial advisors have traditionally begun the asset allocation process by assuming that there is a regular relationship between risk and return. For example, we would start with cash (the lowest-risk, lowest-return asset), then add an increment to compensate us for the risk of buying the next-riskiest asset, and so on. Consider Table 9.1.

Table 9.1 Building-Block Approach to Developing Return Expectations

And so on. This approach is accurate enough in a general way: Over very long periods of time cash will be the least risky and the lowest-return asset, while equities will return much more but also but with substantially more risk. But no one knows what the value of the incremental premiums should be. Even the equity risk premium, probably the most important source of return, is unknowable. Scholars have debated the value of that premium and their estimates for it range from 0 percent to 7 percent.21

And note that the uncertainty of the estimates gets worse as we go out along the risk spectrum: Because all the estimates are linked, errors can compound as we go along. Certainly, 30 years ago no one was predicting that bonds would outperform stocks, but that is what has happened. Maybe 30 years is simply too short a time period to make such a calculation, but note that three decades is longer than the typical investment lifetime for a member ...

Get The Stewardship of Wealth: Successful Private Wealth Management for Investors and Their Advisors, + Website now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.