CHAPTER 10

Credit Spreads

10.1. CREDIT DEFAULT SWAPS (CDS) AND THE CONTINUOUS CDS CURVE

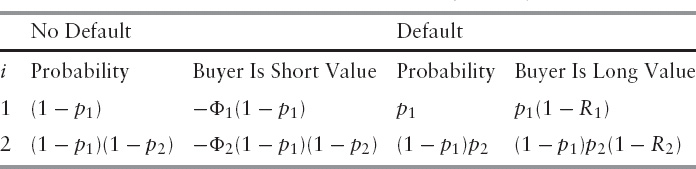

Credit default swap (CDS) contracts are generally contracts in which the buyer agrees to pay Φi at the end of every period i, quarterly for example, in return for insurance against default—where a default event is defined by the contract as failing to pay coupons or certain specified escrow balances dropping below predefined thresholds, and the like. When default occurs, the buyer may deliver a bond that is specified by the contract and get par in return. If the bonds trade at price R, the recovery value, at this time then the CDS contract is worth 1 − R in default, as shown in Table 10.1.

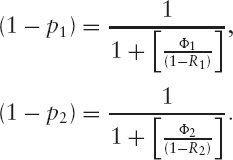

Equating the short value and long value at each successive payment date in order to make the at-the-market swap fair value, that is, zero,

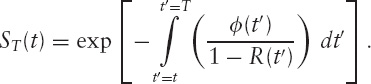

Now consider a continuous payout, φ(t), which means paying at the end of every day, or instant, instead of every quarter. The survival probability ST(t), from time t to T, is given by

TABLE 10.1 Cash flows of a credit default swap I (discrete)

Another way to view this is, given a continuous payout curve φ(t), and a recovery curve R(t), we can implement a variable change { ...

Get The Mathematics of Derivatives: Tools for Designing Numerical Algorithms now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.