11.4 CONCLUSIONS

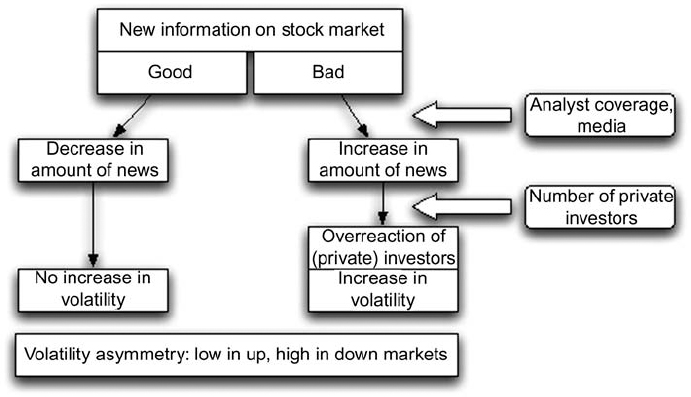

Why is volatility higher in down markets? We proposed in this chapter a model that explains this asymmetry starting from the observation that news tends to be asymmetric as well (compare Figure 11.7): the media report predominantly bad news, as our analysis showed. The effect should be stronger, where analyst coverage and media reports are more frequent, and this can be observed in international data on volatility asymmetry.

A large number of bad news items then leads to overreaction of (predominantly) private investors increasing volatility, thus a larger proportion of private and on average less sophisticated investors on the market increases volatility asymmetry as well. Also this effect can be found in international data on volatility asymmetry, where mostly countries with large numbers of private investors score high. Countries that have large numbers of private investors and sophisticated financial markets with good analyst coverage and news flow have therefore the highest levels of volatility asymmetry (e.g., the USA, UK, and Japan).

Figure 11.7 Functional sketch explaining how the news reaction of private investors can lead to asymmetric volatility.

Given that, it is no surprise that globally volatility asymmetry increases over time, as more and more private investors enter markets and the news flow increases.

The model is supported by two further pieces ...

Get The Handbook of News Analytics in Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.