6.6 INFORMATION EFFICIENCY AND MARKET CAPITALIZATION

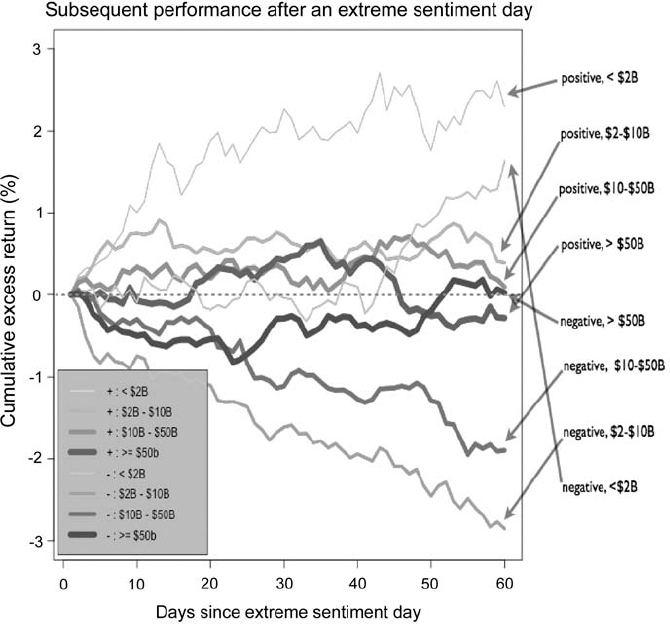

An interesting question to investigate using the Event Study Explorer is the relationship between firm capitalization and the response to news. A reasonable prior is that smaller capitalization firms with less intensive news coverage would show greater response to extreme sentiment news events. Figure 6.13 overlays the event study charts, segmented into four capitalization groups as shown by the label “Cumulative excess return”.

The chart in Figure 6.13 conforms strongly to expectations, with the exception of negative news for the smallest capitalization group.

For positive sentiment events (upper lines) the lowest cap group shows a large response (2–3% excess returns relative to others in the sector/cap group). Note the 60-day scale in Figure 6.13. There is ample time to accumulate positions in these (apparently) under-followed stocks.

For negative sentiment events (lower lines), a similar picture is seen, with the negative excess return lines declining and the largest cap (i.e., most followed) showing the smallest effects. The next two lower capitalization classes line up in beauty contestant fashion, but the smallest cap group (under $2bn) shows anomalous behavior, essentially flat for 40 days, then slightly positive.

Figure 6.13. Subsequent cumulative return after an extreme sentiment day relative to sector and market capitalization ...

Get The Handbook of News Analytics in Finance now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.