Chapter 24

PLANNING FOR CAPITAL INVESTMENTS

CHAPTER LEARNING OBJECTIVES

After studying this chapter, you should be able to:

- Discuss capital budgeting evaluation and explain inputs used in capital budgeting.

- Describe the cash payback technique.

- Explain the net present value method.

- Identify the challenges presented by intangible benefits in capital budgeting.

- Describe the profitability index.

- Indicate the benefits of performing a post-audit.

- Explain the internal rate of return method.

- Describe the annual rate of return method.

PREVIEW OF CHAPTER 24

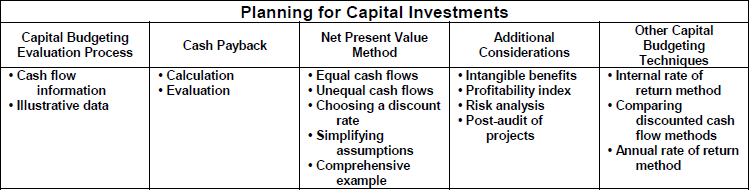

The process of making capital expenditure decisions is referred to as capital budgeting. Capital budgeting involves choosing among various capital projects to find the one(s) that will maximize a company's return on its financial investment. The purpose of this chapter is to discuss the various techniques used to make effective capital budgeting decisions. The content and organization of the chapter are as follows:

CHAPTER REVIEW

The Capital Budgeting Evaluation Process

- (L.O. 1) The capital budgeting evaluation process generally has the following steps:

- Project proposals are requested from departments, plants, and authorized personnel;

- Proposals are screened by a capital budget committee;

- Officers determine which projects are worthy of funding; and

- Board of directors approves capital budget.

Cash Flow Information

2. While accrual ...

Get Study Guide Vol 2 t/a Accounting: Tools for Business Decision Makers, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.