VALUE-BASED FINANCIAL POLICY

A common mistake made even by large, well-known companies, is one of inconsistency. What financial policy is most consistent with the business strategy? What financial policy is most consistent with market expectations and valuation? Too often, companies rush to tactics without consideration of an overall financial strategy, and they ignore the interdependencies between strategic choices and policy elements.1

Optimal financial policy (capital structure, cash and liquidity, and shareholder distributions) is not so much one of finding the correct settings as one of overall alignment with each other and consistency with company strategy and market expectations. The element of surprise, when actions strike a discord with expectations, wreaks havoc on a company’s share price. Witness the case of Tyco, where markets were surprised twice, with the announced breakup and the abrupt abandonment of this about-face in strategy.

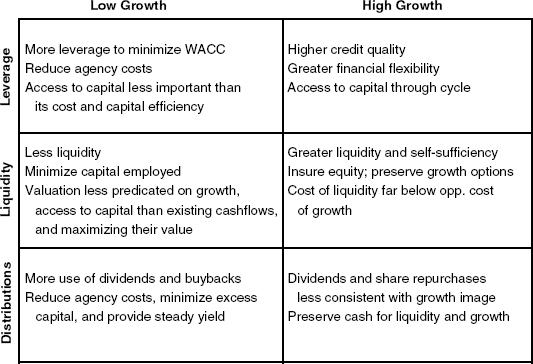

The elements of a financial policy must be well aligned with each other, with the management agenda, and with the expectations reflected in the company’s valuation. Figure 7.1 introduces a framework for aligning the elements of financial policy: financial liquidity, financial leverage, and shareholder distributions, with the business strategy and market valuation.

FIGURE 7.1 Framework for Financial Policy

Though depressed stock prices often ...

Get Strategic Corporate Finance: Applications in Valuation and Capital Structure now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.