Setting Up Payroll

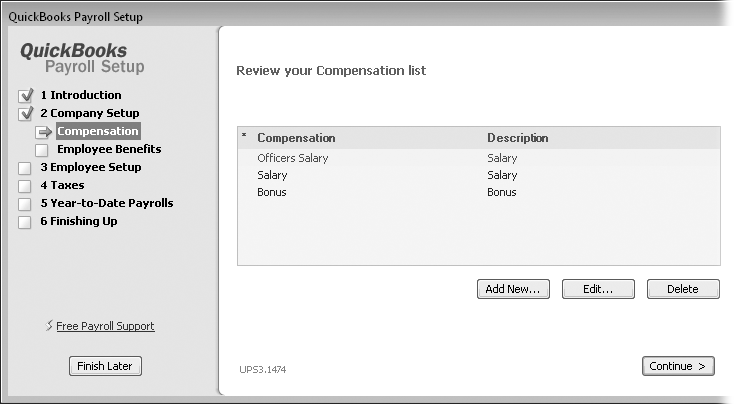

The easiest way to begin setting up payroll is by choosing EmployeesâPayroll Setup, which launches the Payroll Setup wizard. Figure 14-5 shows how the wizard helps you see where you are in the setup process. The following sections cover the payroll setup steps in detail.

You donât have to go through the entire payroll setup process in one shot. Simply click the Finish Later button if you want to take a break, and the wizard remembers everything youâve done so far. (Yes, you have to complete every bit of payroll setup before you can run a payroll.)

Warning

Donât try to set up payroll the same day you want to run it for the first time. Intuit needs a few days to turn on your payroll service after youâve completed your part of the setup process.

Figure 14-5. A green arrow shows which setup task youâre working on (here, thatâs Compensation). As you complete the various steps for setting up payroll, the wizard adds a green checkmark to the completed tasks.

Setting Up Compensation and Benefits

The first payroll task is telling QuickBooks how you compensate your employeesâwhether you pay them a salary, hourly wages, or additional income such as bonuses or commissions. You also specify employee benefits like retirement contributions and insurance premiumsâno matter whether the company or the employees pay for them.

The QuickBooks Payroll Setup wizard takes ...

Get QuickBooks 2011: The Missing Manual now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.