LESSONS ABOUT ALTERNATIVES FROM THE YALE ENDOWMENT

Interest in alternative investments has been enhanced dramatically by the remarkable performance of the Yale Endowment under its long-term director, David Swensen. Since he took over direction of the Endowment in 1985, the Endowment has compiled one of the most impressive records of any investment organization. As will be shown in this section, Yale beats all normal benchmarks including those of peer institutions. What is more impressive perhaps is that it has led the way in revolutionizing the investment practices of educational institutions nationwide. Under David Swensen, Yale has embraced alternative investments and they have been the key to its success. Whether other investors should emulate Yale is a question that will be addressed in this section.

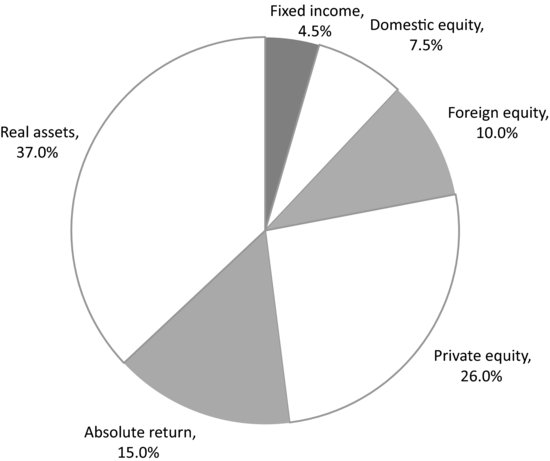

Consider the strategic asset allocation reported in the 2009 Yale Endowment report as illustrated in Figure 13.5. Only 22 percent of the portfolio is in traditional stock and bond investments. It’s interesting that Yale has more invested in foreign equity (10 percent) than in U.S. equity (7.5 percent). All of the rest of the portfolio is in three alternative asset classes:

Private equity (26 percent of portfolio), primarily in venture capital and buyouts

Absolute return (15 percent), split ...

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.