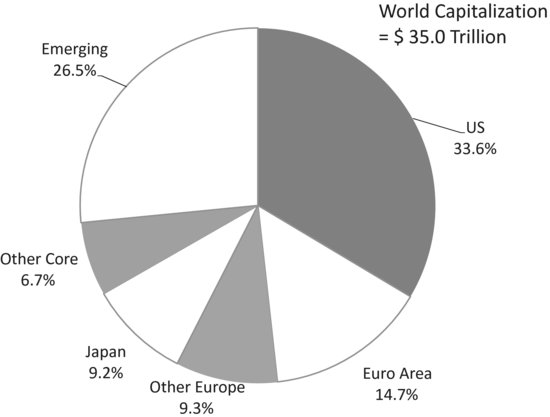

RETURNS ON FOREIGN AND U.S. STOCKS

Figure 5.1 shows the stock market capitalization of the major regions of the world as reported in 2009 in the annual S&P Global Stock Markets Factbook.5 As stated above, foreign industrial countries represent 39.9 percent of the world total, while emerging markets represent another 26.5 percent. Emerging markets are defined by S&P as countries with low per capita income.6 The stocks of industrial countries other than the United States are often referred to as core foreign stocks.

The Morgan Stanley EAFE (Europe, Australasia, and the Far East) index is normally used to describe returns in these core countries even though this index excludes the Canadian market. The makeup of this index (as of 2009) is shown in Table 5.1. 64.4 percent of EAFE’s market capitalization is in the European sub-index consisting of 16 countries and the rest is in the five markets of the Pacific region. Japan’s market is the largest in the index with a 25.1 percent weight. In the late 1980s, this market was even larger than that of the United States.

TABLE 5.1 Country Composition of MSCI EAFE Index

Source for market capitalization: S&P Global Stock Market Factbook, 2009.

Get Portfolio Design: A Modern Approach to Asset Allocation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.