Let’s Get Bootstrapping

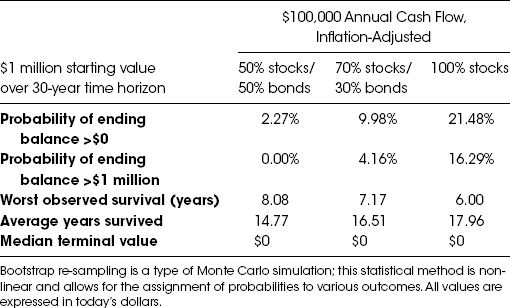

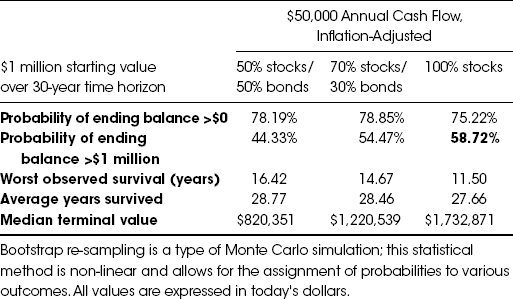

Your goal with a Monte Carlo bootstrap is producing probabilities based on a set of assumptions—starting portfolio value, cash flow levels and time horizon. To give you a general idea, the following scenarios (Tables 6.1 through 6.4) show the impact of differing inflation-adjusted cash flows on a hypothetical $1 million portfolio.

Table 6.1 Scenario 1—$100,000 from $1 Million (10%)

Source: Global Financial Data, Inc., as of 01/06/2012, Thomson Reuters, S&P 500 Total Return Index,1 US 10-Year Government Bond Index, Consumer Price Index from 12/31/1925 to 12/31/2011.

Table 6.2 Scenario 2—$70,000 from $1 Million (7%)

Source: Global Financial Data, Inc., as of 01/06/2012, Thomson Reuters, S&P 500 Total Return Index,2 US 10-Year Government Bond Index, Consumer Price Index from 12/31/1925 to 12/31/2011.

Table 6.3 Scenario 3—$50,000 from $1 Million (5%)

Source: Global Financial Data, Inc., as of 01/06/2012, Thomson Reuters, S&P 500 Total Return Index,3 US 10-Year Government Bond Index, Consumer Price Index from 12/31/1925 to 12/31/2011.

Table 6.4 Scenario 4—$30,000 from $1 Million (3%)

Source: Global Financial Data, Inc., as of 01/06/2012, Thomson Reuters, S&P 500 ...

Get Plan Your Prosperity: The Only Retirement Guide You'll Ever Need, Starting Now--Whether You're 22, 52 or 82 now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.