DMI WITH ADX

Because Wilder's original presentation of DMI was linked with ADX, next I present readers the results from the addition of this filter to our original DMI system.

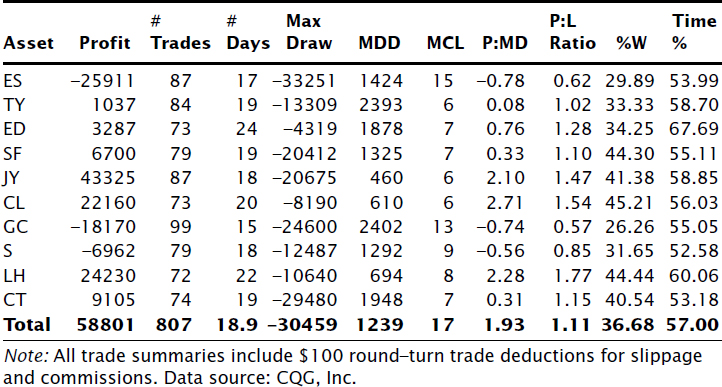

TABLE 3.7 DMI.

Using CQG, the programming code for a simple DMI trading system with an ADX filter is written in this way:

Long Entry:

DDIF(@,10)[-1] XABOVE 20 AND ADX(@,9)[-1] > 20

Long Exit:

DDIF(@,10)[-1] XBELOW 0 OR ADX(@,9)[-1] < 20

Short Entry:

DDIF(@,10)[-1] XBELOW -20 AND ADX(@,9)[-1] > 20

Short Exit:

DDIF(@,10)[-1] XABOVE 0 OR ADX(@,9)[-1] < 20

Table 3.8 presents the backtested portfolio results from December 31, 1992, to December 31, 2002, for this system.

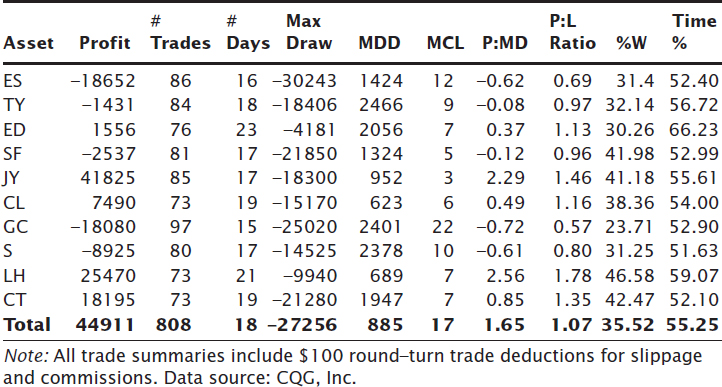

Notice that addition of the ADX filter worsened overall performance. Although one example does not prove that an indicator should be discarded (as proved by our examination of Ichimoku), it does suggest that combining of indicators simply because data vendors or indicator developers link them will not necessarily increase profitability.

TABLE 3.8 DMI with ADX filter.

Get Mechanical Trading Systems: Pairing Trader Psychology with Technical Analysis now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.