6

Risk Management

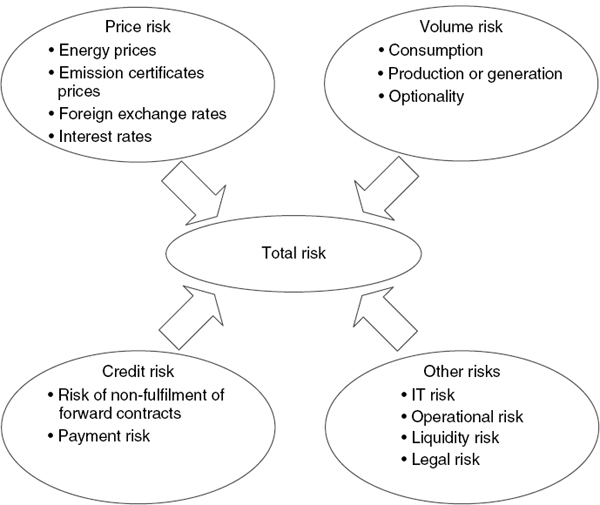

In this chapter the main features of a risk management process in the energy industry will be described in a practice-oriented fashion. The risk management process starts with a risk map.

This risk map should contain the main risks of the considered company. Figure 6.1 illustrates such a risk map.

Figure 6.1 Risk map

Among the quantifiable risks, the price risk seems to be the most significant risk. Therefore the price risk will be considered first.

6.1 MARKET PRICE EXPOSURE

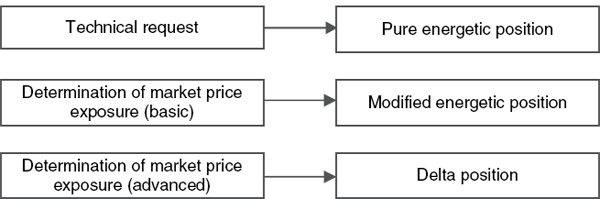

A key feature of the risk management process is the transparentising of market price exposures. First, the position of the entire portfolio has to be determined. There are several ways to definite the position of an energy portfolio, which are illustrated in Figure 6.2.

Figure 6.2 Determination of the position of an energy portfolio

Market participants with assets such as exploration fields, pipelines, or power plants must know their energetic position for technical reasons.

Using this energetic position for explaining market price exposures is possible, if some corrections are made. The most important adjustments are:

- – Including futures contracts, even if there is no physical delivery.

- – Including the financial leg of indexed contracts.

- – Including the option delta.

A modified energetic ...

Get Managing Energy Risk: An Integrated View on Power and Other Energy Markets now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.