1.2 Tax Rates Based on Filing Status

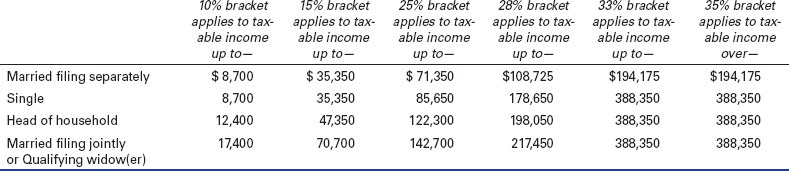

The most favorable tax brackets apply to married persons filing jointly and qualifying widow(er)s (1.11), who also use the joint return rates. The least favorable brackets are those for married persons filing separately, but filing separately is still advisable for married couples in certain situations (1.3). See Table 1-1 for a comparison of the 2012 tax rate brackets.

Table 1-1 Taxable Income Brackets for 2012

If you have children and are unmarried at the end of the year, do not assume that your filing status is single. If your child lives with you in a home you maintain, you generally may file as a head of household (1.12), which allows you to use more favorable tax rates than a single person. If you were widowed in either of the two prior years and maintain a household for your dependent child, you generally may file as a qualified widow(er), which allows you to use favorable joint return rates (1.11).

If you are married at the end of the year but for the second half of the year you lived with your child apart from your spouse, and you and your spouse agree not to file jointly, you may use head of household tax rates, which are more favorable than those for married persons filing separately.

What is your top tax bracket and effective tax rate?

For 2012 your top marginal tax rate can be either 10%, 15%, 25%, 28%, 33%, or 35%, depending on ...

Get J.K. Lasser's Your Income Tax 2013: For Preparing Your 2012 Tax Return now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.