25.4 Qualifying for Child and Dependent Care Credit

Did you hire someone to care for your children or other dependents while you work? If so, you may qualify for a tax credit for the expenses. You may claim the credit even if you work part time. You may claim the credit if you work from home and pay someone to care for your child while you are there. The credit is generally available to the extent you have earnings from employment. Your employer may have a plan qualifying for tax-free child care and, if you are covered, you may be unable to claim a tax credit (25.8).

Where to claim the credit.

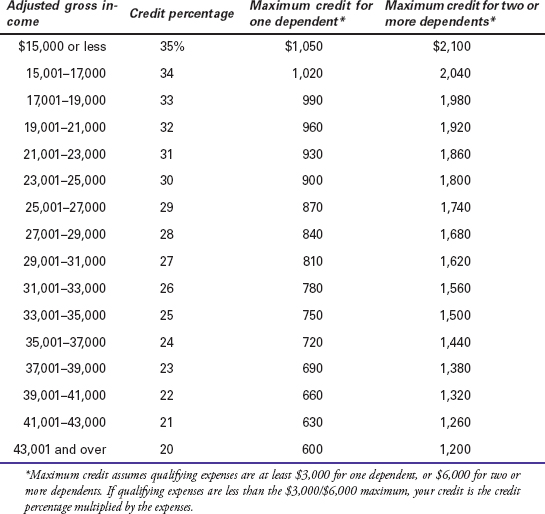

The credit is claimed on Form 2441 if you file Form 1040 or Form 1040A. The size of the credit depends on the amount of your care expenses, number of dependents, and income. Depending on your adjusted gross income, the credit for 2012 is 20% to 35% of up to $3,000 of care expenses for one dependent and up to $6,000 of expenses for two or more dependents. The minimum credit percentage of 20% applies if your adjusted gross income exceeds $43,000. See Table 25-1 (25.5).

Table 25-1 Allowable Credit for 2012*

Get J.K. Lasser's Your Income Tax 2013: For Preparing Your 2012 Tax Return now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.