25.4 Empirical Work

The first empirical work on speculative attacks was done by Blanco and Garber (1986). They applied the KFG model to currency crises in Mexico in 1976 and 1981–1982. B&G applied KFG directly with the exception that in the crisis the monetary authority devalues the currency instead of allowing a run on international reserves. Preemptive devaluation is a common response to impending currency crises, as the devaluation protects reserve stocks.

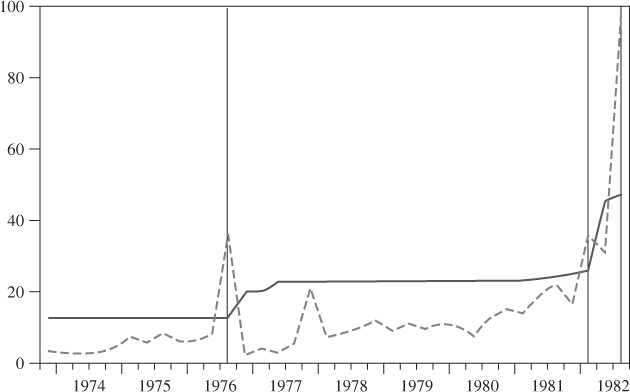

We replicate two figures (Figs. 25.6 and 25.7) taken from B&G that illustrate the empirical content of their work. Figure 25.6 depicts the shadow-exchange-rate-driven series of “exchange rates conditional on devaluation” (ERCD) as given by Equation (25.18), the sequence of fixed exchange rates and the devaluation dates. In the figure, as the ERCD rises toward the sequence of fixed exchange rates the probability of one-quarter-ahead devaluation also rises.

Figure 25.6 Exchange rates and devaluation dates from B&G. Solid line is the fixed exchange rate. Hatched line is the exchange rate conditional on devaluation.

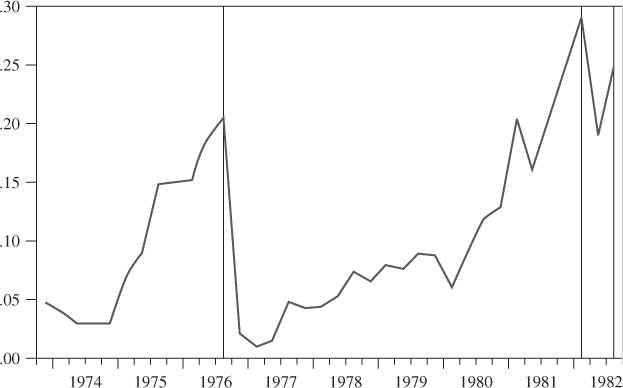

Figure 25.7 Devaluation probabilities from B&G.

In Figure 25.7, we have reconstructed the B&G devaluation probabilities and plotted the actual devaluation dates. Clearly, the probability of a crisis rose as a crisis ...

Get Handbook of Exchange Rates now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.