Special Dividends

A special dividend is exactly what it sounds like. It’s a dividend that’s, well, special. Any questions?

A special dividend is usually a one-time payment, often much more than the regular dividend.

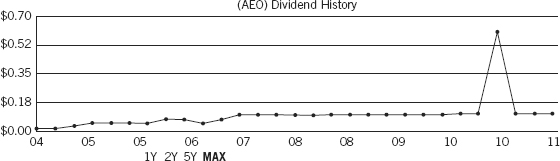

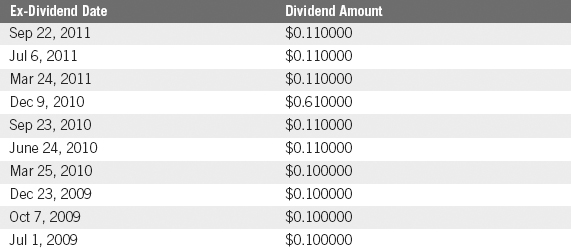

Look at the dividend chart (Figure 7.3) and data (Figure 7.4) on American Eagle Outfitters (NYSE: AEO). You can see that in 2009 through March 2010, American Eagle paid shareholders $0.10 per share on a quarterly basis. It raised the dividend to $0.11 in June 2010.

Then in December the dividend spiked to $0.61 but immediately went back down to $0.11.

On December 2, American Eagle declared a special $0.50 per share dividend on top of its regular $0.11 quarterly dividend. So shareholders received $0.61 per share that quarter.

A company may declare a special dividend for a number of reasons. One of the most common is because shareholders demand it. We saw that in 2004, when Microsoft, sitting on billions of dollars in cash, paid shareholders a special dividend of $3 per share. The payout barely put a dent in the company’s cash stash but somewhat appeased investors who were unhappy that the company was hoarding ...

Get Get Rich with Dividends: A Proven System for Earning Double-Digit Returns now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.