Performance of Perpetual Dividend Raisers

It was never my thinking that made the big money for me. It was always my sitting.

—Jesse Livermore, legendary investor

Numerous studies show that companies that raise dividends have stocks that outperform those that don’t.

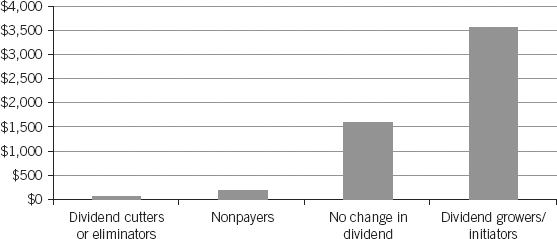

According to Ned Davis Research, companies that raised or initiated dividends from 1972 to 2010 did significantly better than those that didn’t. And the companies that did not pay a dividend or, heaven forbid, cut their dividend, weren’t even in the same ballpark as the dividend payers and raisers.

After 38 years, the dividend cutters were worth only $82 after a $100 original investment, a compound annual growth rate of −0.52%. The nonpayers were worth a whopping total of $194, for a minuscule 1.76% annual return. Companies that paid a dividend but kept it flat were worth $1,610, or 7.59% annually. But the dividend raisers/initiators generated a compound annual growth rate of 9.84% and were worth $3,545. (See Figure 3.1.)

There’s nothing wrong with 9.84% annually over 38 years. But a little later on, I’ll show you how to generate at least 12% annual returns, which would turn that $100 into nearly $7,500 in the same period.

Historically, the S&P Dividend Aristocrat Index has outperformed the S&P 500. Since inception in 1990, Aristocrats have returned ...

Get Get Rich with Dividends: A Proven System for Earning Double-Digit Returns now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.