TIME OF POSSESSION: 8/14/10

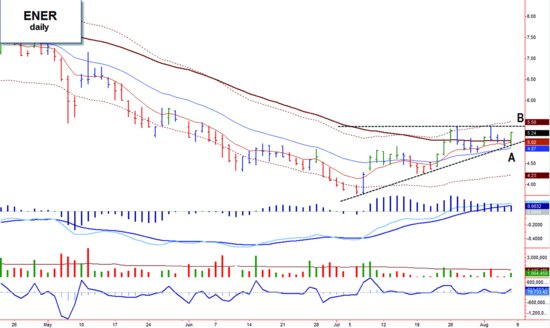

The stock of Energy Conversion Devices, Inc. (ENER) has been beaten down over the past few years. However, the demand is starting to reappear for its thin-film solar products; the current stock price reflects all the risks but none of the upside potential. A significant turnaround seems to be in the cards, but the market does not believe in it, as reflected in the extremely oversold price. Combine that with the large short position (25 percent of the float), stellar earnings, guidance from others in the sector, and a promising technical set-up (Figure 12.15 ), and the odds of a successful trade look good.

Figure 12.15 ENER daily chart.

Daily characteristics of the trade set-up: • ENER bounced off its up-trendline and surged 6.5 percent on double its normal volume, when the Dow was down 150 at one point on Friday (bar A). • It closed above resistance and at the high of the day (bar A). • An ascending triangle was near completion (B). • The shorts are starting to stack up at the exit.

Trade Plan

My trade plan for managing this set-up involved the following.

Entry

Get Fly Fishing the Stock Market: How to Search for, Catch, and Net the Market's Best Trades now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.