GREATER FOOL TRADE: 4/17/10

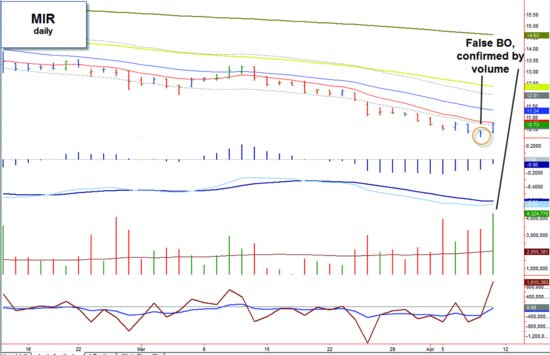

Some would question this trade and possibly classify it as a “greater fool theory trade.” While I might have appeared the fool chasing a gap open, I was confident that the “greatest of all fools” would show up at a higher price to buy my shares. There is no reason to be short with this stock after a drop of 35 percent, a double bottom on the weekly/daily, and a retest of its March 2009 lows. However, the short position was larger than average as latecomers had moved in for the kill. Undoubtedly, this would set up the ingredients for an explosive reversal when the signs manifested—just a matter of timing. On Friday, a false downside breakout, confirmed by six times normal volume, was posted (Figure 12.10 ). Then on Sunday afternoon, a press release was issued, announcing a $1.6 billion merger with RRI. The perfect storm had formed. The Monday open was set up to see some trigger-happy panic on the part of the shorts who were now trapped.

Figure 12.10 MIR daily chart.

I adjusted my trading strategy to a very short time frame, hoping to scalp a quick profit from the squeeze at the market open. I decided to enter based on a 1-minute chart only if and when I saw two consecutive bars with higher lows (Figure 12.11 ). I felt that if this were to happen, following a big gap, it would indicate some furious buying.

Figure 12.11 MIR 1-minute chart.

I entered ...

Get Fly Fishing the Stock Market: How to Search for, Catch, and Net the Market's Best Trades now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.