A GEM IN THE JUNK PILE: 1/1/10

Regional banks represent one of the very few values left in this bloated market. After reviewing what happened during the last week of 2008, I discovered that much of the buying went to the extremely undervalued bottom dwellers. So this week, I dredged the bottom to find BANR (Banner Corporation, in the Savings and Loan banking sector).

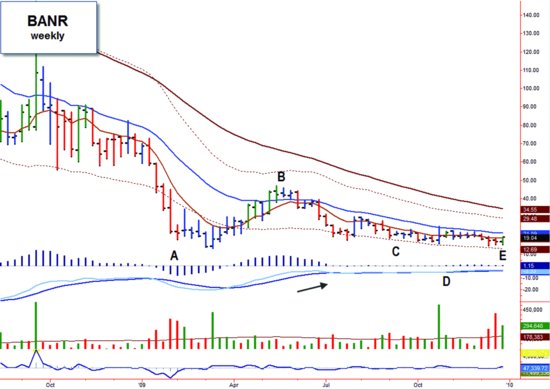

The company recently withdrew its announcement of a secondary offering based on the new upbeat guidance and renewed confidence in its ability to be profitable without the offering. This news peeled the stock off the bottom on strong volume last week as it traced a reversal bar on the weekly chart (Figure 12.7 ).

Figure 12.7 BANR weekly chart.

Weekly characteristics of the trade set-up: • Prices drop hard on exhaustive volume (A). • A surge back above value before weakness sets in again (B). • A consolidation pattern develops (C). • A bullish MACD crossover occurs on strong volume (D). • Prices close in the value zone at the high of the week on strong volume (E).

This chart clearly shows the stock dropping hard with extreme volume, then retesting those lows, and finally flat-lining with each bar getting smaller and smaller while bearishness dried up. Based on (1) the news, (2) the extremely oversold condition, (3) the increasing bullishness of the indicators, and (4) the volume surge on Friday, I decided ...

Get Fly Fishing the Stock Market: How to Search for, Catch, and Net the Market's Best Trades now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.