ACCOUNTING FOR SHAREHOLDERS' EQUITY

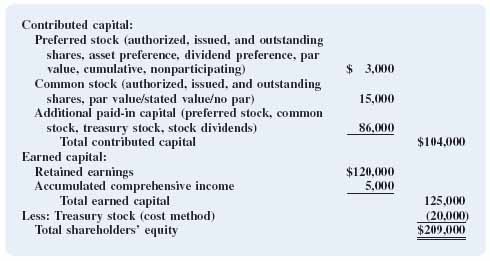

The shareholders' equity section of a corporate balance sheet consists of two major components: (1) contributed capital, which primarily reflects contributions of capital from shareholders and includes preferred stock, common stock, and additional paid-in capital3 less treasury stock, and (2) earned capital, which reflects the amount of assets earned and retained by the corporation and consists essentially of retained earnings and accumulated comprehensive income. An example of the shareholders' equity section of a corporate balance sheet appears in Figure 12-5. Spend a moment to review it because it provides an outline of the remaining discussion in this chapter. Note that most companies disclose treasury stock at the bottom of the shareholders' equity section even though it represents a reduction of contributed capital.

3. While the title additional paid-in capital is the most common, there is some variation across companies. For example, The New York Times Company uses additional capital, Goodyear Tire & Rubber uses capital surplus, and Chevron Texaco Corporation uses capital in excess of par value.

FIGURE 12-5 Shareholders' equity section of balance sheet

![]() Non-U.S. companies, many of which publish IFRS-based financial statements, use different ...

Non-U.S. companies, many of which publish IFRS-based financial statements, use different ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.