REVIEW PROBLEM

Assume that Southern Carbide issues 500 bonds, each with a $1,000 face value on January 1, 2012. The five-year bonds have an annual stated interest rate of 6 percent, to be paid semi-annually on December 31 and June 30. The bonds are issued at 91.89, providing an effective annual interest rate of 8 percent. A call provision in the bond contract states that the bonds can be redeemed by Southern Carbide after December 31, 2012, for 96.0. Assume that Southern Carbide exercises this provision on July 1, 2013.

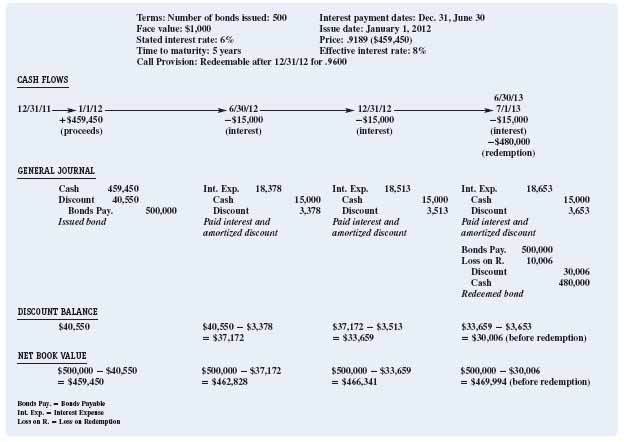

Figure 11-13 provides the cash flows, journal entries, discount balance, and net book value of the bonds from the time of the bond issuance to the redemption. An explanation of each calculation follows.

FIGURE 11-13 Review problem

Cash Flow Calculations

Proceeds. The proceeds of the bond issuance ($459,450) were calculated by multiplying the number of bonds issued (500) by the price per bond ($918.90).

Interest Payments. The semiannual interest payment ($15,000) was calculated by multiplying the number of bonds issued (500) by the face value of each bond ($1,000) by half the stated annual interest rate (3 percent).

Redemption Payment (7/1/13). The payment required to redeem the bonds on July 1, 2013 ($480,000), was calculated by multiplying the number of bonds issued (500) by the redemption price per bond ($960).

Journal Entry Calculations

At Issuance. Cash ($459,450) ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.