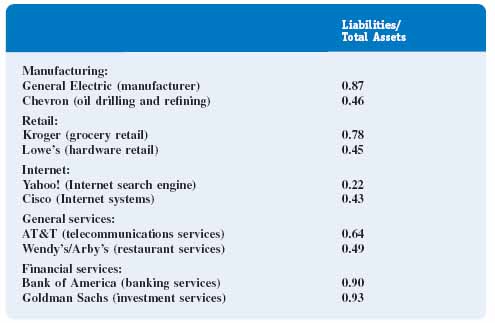

THE RELATIVE SIZE OF LIABILITIES ON THE BALANCE SHEET

Figure 10-1 contains liabilities as a percentage of total assets, often referred to as the debt ratio, for selected firms. The main financing source for financial institutions is clearly debt. Customer demand deposits and short-term debt are primarily responsible. General Electric's financial subsidiary, which is set up to provide financing to its customers on big-ticket sales, is basically a financial institution, accounting for GE's large debt ratio. Companies like AT&T and Kroger invest heavily in property, plant, and equipment that is financed through debt, while Internet firms have generated most of their financing by issuing equity.

FIGURE 10-1 Liabilities as a percentage of total assets

![]() Internet companies like Yahoo! and Google carry very little debt on their balance sheets, while large manufacturers like Kimberly-Clark and General Electric have debt amounts that are well over 50 percent of total assets. Comment on why such differences might exist.

Internet companies like Yahoo! and Google carry very little debt on their balance sheets, while large manufacturers like Kimberly-Clark and General Electric have debt amounts that are well over 50 percent of total assets. Comment on why such differences might exist.

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.