DEFERRED INCOME TAXES: ADDITIONAL ISSUES

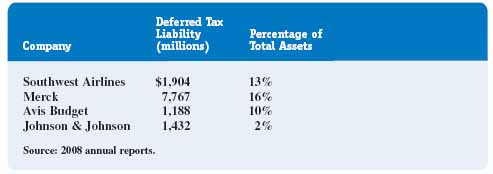

The size of the deferred income tax liability account is usually related to the size of a company's investment in fixed assets. Note in Figure 10B-3 that large manufacturing companies, such as Merck, often carry huge balances in their deferred income tax accounts. Such companies normally depreciate their fixed assets using accelerated methods for tax purposes and straight-line for financial reporting purposes, and the resulting differences between their tax liability and income tax expense can be quite large. On the other hand, financial institutions, which carry limited investments in fixed assets, rarely show balances in the deferred income tax account. JPMorgan Chase, the American Express Company, and Safeco Insurance, for example, report no deferred income taxes on their balance sheets.

9. In this example, net income before taxes reported on Midland's income statement would be $7,000 (2009), $7,000 (2010), and $7,000 (2011), giving rise to an income tax expense of $2,100 ($7,000 X .30) for each year.

FIGURE 10B-3 Deferred income tax liability (selected U.S. companies)

As explained earlier, the deferred income tax account can be viewed as a liability, reflecting an obligation for additional income tax that must be paid in the future as certain tax benefits reverse. However, growing companies tend to purchase more fixed assets than they ...

Get Financial Accounting: In an Economic Context now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.