Name

ODDLPRICE

Synopsis

Use ODDLPRICE (an Analysis ToolPak function) with securities that have an abnormally long or short last period to determine the cost of the security. The cost is based on the amount the security cost for each $100 of the face value.

To Calculate

=ODDLPRICE(Settlement,Maturity,last_Interest,Rate,Yld,Redemption,Frequency,Basis)

The Basis argument is the only optional

argument. All other arguments must have values.

-

Last_Interest Indicates the date when the last coupon is due. The argument can be an actual date, a cell reference (e.g., A3), or the results of another function.

-

Rate Specifies a numeric value that represents the annual coupon rate for the security. For example, if the security has a coupon rate of 9% the value of this argument is

0.09.-

Yld Indicates the annual yield (interest paid) of the security. The value of the argument should be a numeric value that represents the yield percentage. For example, if the security pays 5% annually, the value of this argument would be

0.05.

Example

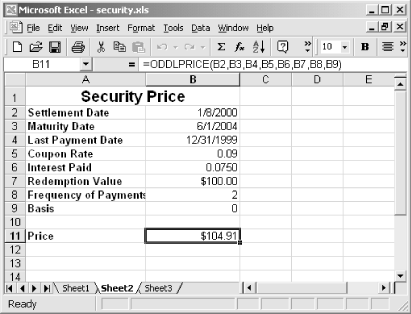

Figure 12-20 illustrates how ODDLPRICE can be used to determine the price of a security with an abnormally long or short last coupon period.

Figure 12-20. Use ODDLPRICE if the last payment period is longer or shorter than the other periods

Get Excel 2000 in a Nutshell now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.