HIGH-FREQUENCY DATA ARE VOLUMINOUS

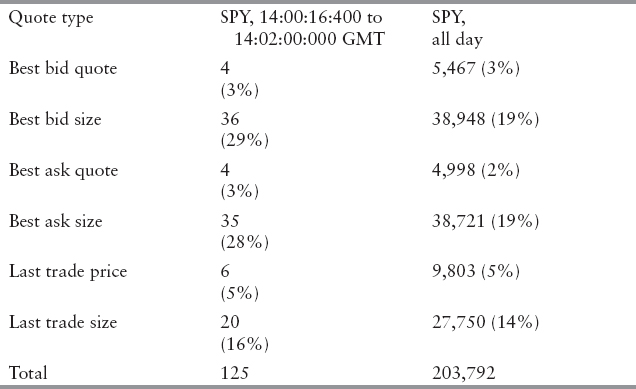

The nearly two-minute sample of tick data for SPDR S&P 500 ETF (ticker SPY) shown in Exhibit 20.1 contained over 100 observations of Level I data: best bid quotes and sizes, best ask quotes and sizes, and last trade prices and sizes. Exhibit 20.3 summarizes the breakdown of the data points provided by NYSE Arca for SPY from 14:00:16:400 to 14:02:00:000 GMT on November 9, 2009, and SPY throughout the day on November 9, 2009. Other Level I data omitted from Exhibit 20.3 include cumulative daily trade volume for SPY. The number of quotes observed on November 9, 2009, for SPY alone would comprise over 160 years of daily open, high, low, close and volume data points, assuming an average of 252 trading days per year.

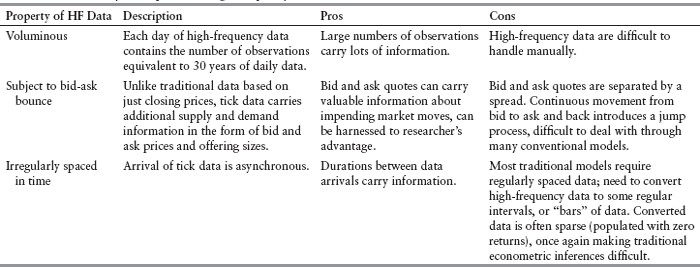

EXHIBIT 20.2 Summary of Properties of High-Frequency Data

EXHIBIT 20.3 Summary Statistics for SPY Level I Quotes on November 9, 2009

Get Equity Valuation and Portfolio Management now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.