23

Short Strangles

A short strangle is similar to a short straddle. What is a short strangle? A short strangle consists of two legs, a short out-of-the-money call and a short out-of-the-money put from the same series. Selling a strangle involves selling both options simultaneously.

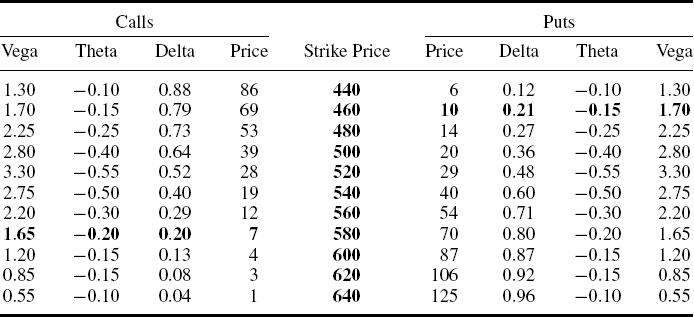

From the matrix of Sep BP option prices (Table 23.1, repeated from Table 16.1), selling the 460/580 strangle consists of two legs, selling the 460 put at 10 and simultaneously selling the 580 call at 7. The price received for the strangle is 17 ticks (equivalent to £170) per strangle sold, the sum of the 10 received for the 460 put and the 7 received for the 580 call. These 17 ticks represent the maximum profit on selling the strangle. If BP is between 460 and 580 (i.e. £4.60 and £5.80) on Sep expiry, then both the 460 puts and 580 calls will expire worthless. The maximum possible value of the strangle is unlimited to the upside and limited only by zero to the downside. The “odds” on selling the Sep 460/580 strangle at 17 are therefore infinity to 1 against.

Table 23.1 LIFFE Sep BP option prices and Greeks at close on 21 July 2008 (BP share price (LSE) = 522 (i.e. £5.22))

Selling strangles is popular in practice. There are plenty of market participants who say things such as “BP can't go beneath £4.60” and “there's no way BP gets above £5.80 in the next couple of months”. It is these sorts of dogmatic ...

Get Equity and Index Options Explained now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.