Chapter 3. Leading US Mobile Payment Experiences

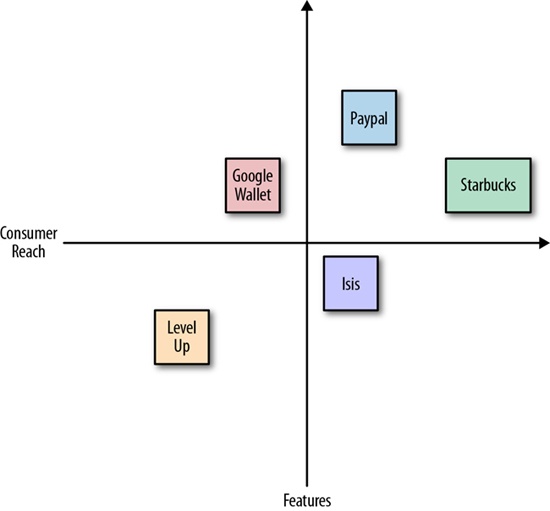

Today there are mobile payment initiatives by everyone from traditional financial networks like Visa and MasterCard to upstarts like Loop and Clinkle looking to cash in on the gold rush for consumer mindshare of the mobile payments space. Figure 3-1 illustrates what the US mobile payments field looks like to date, with startups like LevelUp giving established financial institutions and technology companies like Google and MNOs (Isis) a run for their money.

As we saw in Chapter 2, there are three primary ecosystems that power mobile commerce: NFC, cloud, and closed loop payments. The structure and performance of these distinct ecosystems have a significant impact on the mobile consumer’s experience at the point of sale. In this chapter, we’ll closely examine some leading experiences in the US mobile brick-and-mortar payments market, highlighting the innovations and shortcomings of their designs. In particular, we’ll focus on three key aspects of payments design that I feel are the most crucial to the success of a mobile payment experience:

- Payments

Using the app at a point of sale

- Feedback

Instructing the user before and after transactions

- Security

Protecting the user’s financial ...

Get Designing Mobile Payment Experiences now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.