APPENDIX 13A

Example of Computing Downside Beta Estimates

Niel Patel

INTRODUCTION

This appendix presents an example of how to compute a downside beta estimate for a guideline public company. Similar to ordinary least squares (OLS) beta and sum beta estimates, this guideline public company downside beta estimate can be used as a proxy beta estimate for a division, reporting unit, or closely held company.

COMPUTING DOWNSIDE BETA ESTIMATES

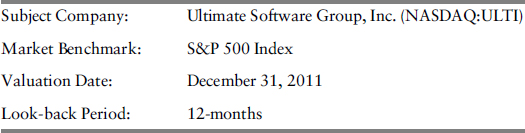

Estimating a downside beta for a guideline public company as of a valuation date can be performed in the general steps shown using Microsoft Excel1 and common market data that can be obtained from industry data providers, such as Bloomberg and Standard & Poor's Capital IQ. For purposes of this example, we will be estimating downside beta using the following assumptions as presented in Exhibit 13A.1.2,3

EXHIBIT 13A.1 Downside Beta Assumptions

Exhibit 13A.2 presents the excess returns of Ultimate Software Group, Inc. and the excess returns of the S&P 500 Index over a 12-month look-back period. For more details regarding the computation of realized excess returns, see Chapter 11A.

Before proceeding to the next paragraph on computing downside beta estimate, please make sure your Excel worksheet looks exactly like Exhibit 13A.2.4

We next present the procedure to compute a downside beta estimate with respect ...

Get Cost of Capital: Applications and Examples, + Website, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.