APPENDIX 4A

Equivalency of Capitalizing Residual Income

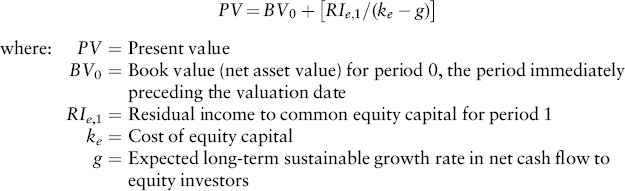

As we discuss in Chapter 3, the literature includes an alternative formulation of the valuation of net cash flows based on residual income. The equivalent residual income valuation to Formula 4.6 as applied to net cash flows to equity capital is:

(Formula 4A.1)

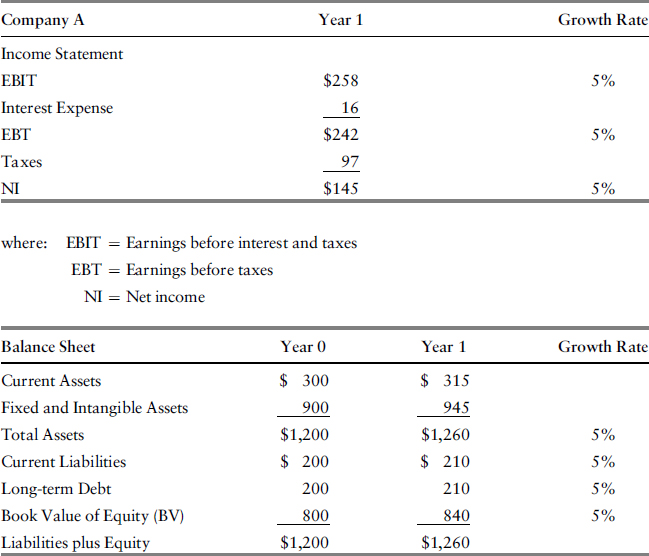

Exhibit 4A.1 shows an example of data that we will use below for valuing Company A using residual earnings consistent with the example shown in Formula 4.7, which uses the Gordon Growth Model.

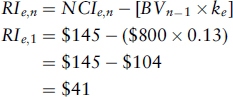

Applying Formula 3A.2 to the data shown in Exhibit 4A.1 and assuming the ke = 13%, we arrive at the residual income for the common equity capital:

(Formula 4A.2)

EXHIBIT 4A.1 Example of Valuation Using Residual Income to Common Equity

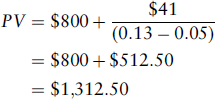

Now applying Formula 4A.1 we get:

(Formula 4A.3)

This is the same result we obtained in Formula 4.7.

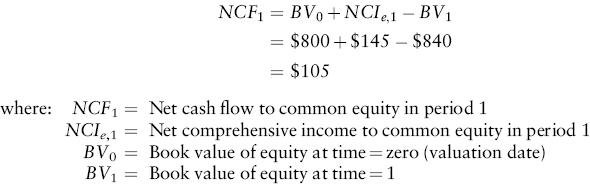

Using th clean surplus accounting statement, Formula 3A.4, we obtain:

(Formula 4A.4)

This is the same net cash flow that we capitalized in Formula 4.7. ...

Get Cost of Capital: Applications and Examples, + Website, 5th Edition now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.