ADDITIONAL EVENTS IN THE TRADE LIFE CYCLE

Early redemption

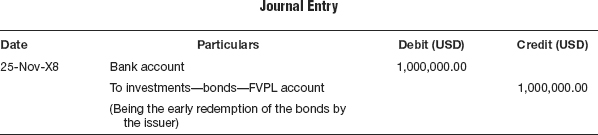

Certain debt instruments have a call provision which grants the issuer an option to retire all or part of the issue prior to the maturity date as mentioned in the document, even though most of the new bond issues usually have some restrictions against certain types of early redemption. When the issuer exercises the call provision, then the bond gets redeemed as per the terms of the issue. Interest, however, is paid until the date of actual payment of the money by the issuer. Assuming that the bonds are to be redeemed at par whenever the call is made, and assuming that the call is made on 25-Nov-X8, the accounting entry that would be passed is as shown in Table 2.21.

Table 2.21 On early redemption

Maturity

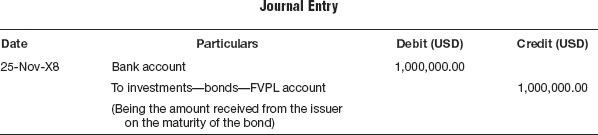

The issuer returns the money to the investor on the maturity date as given in the original offer document. Interest is paid until the date of actual payment of the money to the investor. The accounting entry passed on maturity of the bond is as shown in Table 2.22.

Table 2.22 On maturity

Write off

The bond might have to be written off before the maturity date mentioned in the original offer document due to impairment or inability to pay by the issuer either in full or in part to the extent not recoverable. Interest is accounted ...

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.