INTEREST RATE CAP INSTRUMENT—AN ILLUSTRATION

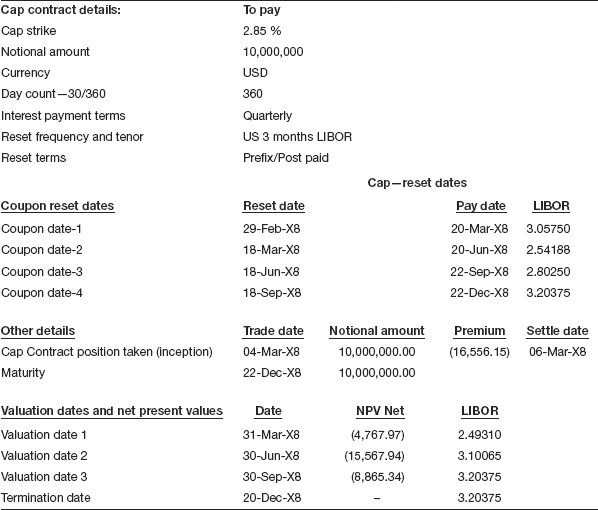

The details of the CAP instrument is shown in Table 9.2 for the purpose of this illustration.

Table 9.2 Details of the cap instrument

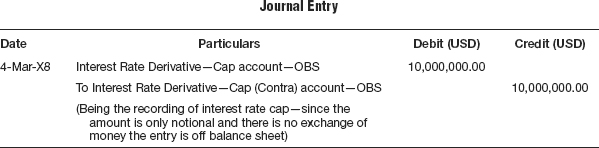

Recording the trade—contingent

Here in this contract, which is a ‘a pay’ interest rate cap, the contract is based on making a payment to the buyer of the contract when the reference rate exceeds the specified cap rate on the reset date calculated on the notional amount of the contract. However, since this is just a notional amount and no physical exchange of money takes place, the off balance sheet entry to record the transaction is made in the book of accounts, as shown in Table 9.3.

Table 9.3 At the inception of interest rate cap contract

Account for the premium on the trade

In a ‘to pay’ interest rate cap trade, the buyer of the contract receives a non-refundable premium from the seller of the contract. If the interest rate rises above the cap rate, interest payment has to be made to the buyer as specified in the previous paragraph. The premium is calculated at the time the cap is established on the basis of the cap rate, the reference interest rate, the notional amount, the maturity period, and market volatility of interest rates. The premium for an interest rate cap also depends on several other factors ...

Get Accounting for Investments, Volume 2: Fixed Income Securities and Interest Rate Derivatives—A Practitioner's Guide now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.