Rounding Top and Bottom

Besides the spiking prices associated with head and shoulders and gaps, some trends are found in a softer rounding effect. The rounding top or bottom marks a potential reversal, but without the clear spiking price points expected in so many types of signals.

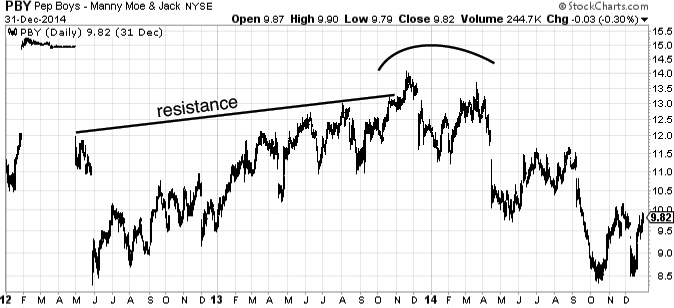

A rounding top is most convincing as a signal of reversal when it “rounds” higher than resistance. In such a case, you expect to see price retreat to the downside in a new bear market. An example is found in Figure 5.5.

Figure 5.5 Rounding top (Chart courtesy of StockCharts.com)

Unlike the heads and shoulders with its fast-moving and spiking prices, the rounding ...

Get A Technical Approach To Trend Analysis: Practical Trade Timing for Enhanced Profits now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.