3

LEARNING FROM LYFT AND UBER

IN THE SUMMER OF 2000, MY EXECUTIVE TEAM AND I DID SOME work with Dan and Meredith Beam, of BEAM inc., a strategy consulting firm, on a strategic planning process for our company. We no longer had one primary business; we had three: book publishing, conferences, and online publishing, which had overlapping audiences but each of which had different demands for investment, go-to-market strategies, and paths to revenue. We needed to find a way to reconcile these different lines of business into a coherent whole.

Dan and Meredith help companies build maps of their business models—one-page pictures that describe, to use their words, “how all the elements of a business work together to build marketplace advantage and company value.”

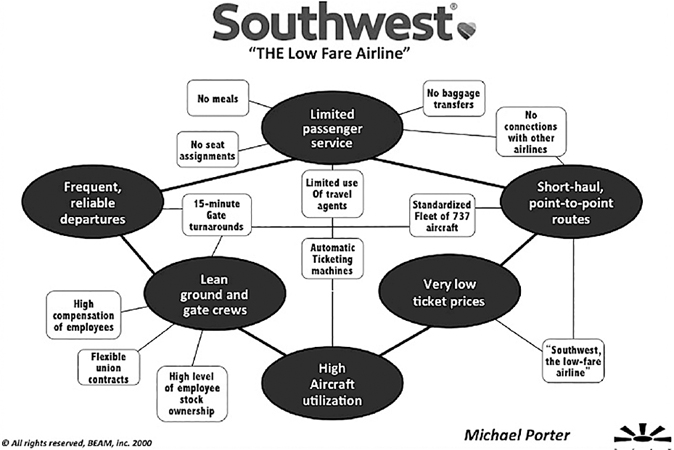

The Beams used Southwest Airlines as one of their examples, basing their business model map of Southwest on work originally done by Michael Porter. As you can see from the diagram on the next page, various differentiating factors in Southwest’s model all go together. No seat assignments, point-to-point routes, no interconnection with other airlines: all are part of a strategy that allows Southwest to offer low fares with lean ground crews and rapid turnaround.

It’s easy to conclude that two companies selling similar products and services are in the same business; the Beams argued otherwise.

Yes, Southwest is an airline like any other, but its business model—the way all the pieces work together to create customer value and company advantage—is very different from that of an airline company using the more traditional hub-and-spoke model. In a similar way, we were trying to understand what made us different from our competitors in the technical book and conference business.

As part of the exercise, the Beams ask their clients to develop a vision of their core strategic positioning and a vision of who they want to become. Through that process, we were able to make clear to ourselves and all our employees that we were not just a computer book publisher that also happened to do conferences and online publishing, but that our core business was something much deeper. As I came to realize, our business was really “changing the world by spreading the knowledge of innovators.”

That required a set of core competencies that enabled both our publishing and events business, and could eventually enable other related businesses. As we articulated our core competencies at the time, they were:

• Knowing what’s cool and important, and evangelizing it

• Recognizing influential early adopters (whom I sometimes referred to as “alpha geeks”) and leveraging their expertise

• Reducing the learning curve and enhancing the depth and quality of information

• Direct connection to customers and people who impact the business

• Fostering a company and culture that make people feel their work can make the world a better place

These competencies were reflected in our book and conference business, but once we separated them in our minds from the details of books and conferences, we were able to develop a more effective strategy. For example, we understood in ways that other publishers didn’t that we couldn’t just sell through retailers, but had to double down on mechanisms for direct connection with customers.

We’d sold our books direct to consumers before we’d sold through bookstores, and we’d been working to develop the market for ebooks since 1987, which we also sold direct-to-consumer. As various ebook platforms emerged, most publishers ignored ebooks or treated them as a sideshow. We understood that one day the majority of our sales would be digital; if we were to maintain our direct connection to consumers, we needed to build our own digital platform. Later that year (seven years before the Kindle legitimized ebooks for other publishers) we launched Safari, a subscription-based online service for ebooks. Over the years since, we have successfully migrated Safari to a service that provides not just ebooks but also video and other learning modalities, including live online training.

We were also able to see the virtuous tie-ins between publishing and our conference business. Both required us to seek out people living on the edge of the future, people with deep expertise, and to create businesses that helped them to spread their knowledge. One of the jobs we did for that community was to help them build their status and increase their impact. All of our lines of business could be put in service to this goal. Realizing that community was a seedbed for many an entrepreneurial opportunity, we launched O’Reilly Ventures as an internal venture firm, which by 2005 had grown into O’Reilly AlphaTech Ventures (OATV), an independent early-stage venture capital firm. And in 2003 we launched “Foo Camp,” our annual unconference (an event for which the program is not set in advance, but constructed by the attendees on the spot) in which we ask our community of “alpha geeks” to show us what they are working on.

In addition, we recognized that evangelizing new technologies and encouraging people to work toward a better future was profoundly motivating to the network of experts, employees, and customers that we were trying to build. We saw that the kind of activism and community building that we’d done in the early days of the commercial web and what we’d done with open source could and should be replicated as an ongoing part of our business. In 2004 we began our storytelling about Web 2.0. In 2005 we launched a magazine (Make: magazine) and in 2006 a “county fair for robots” (Maker Faire) that were expressions yet again of a catalytic movement (the Maker movement) using cheap, reusable components to enable a torrent of combinatorial innovation.

MEME MAPS

After working with the Beams, I realized in retrospect that I’d instinctively used a variation of their technique for building my map of open source software. Rather than mapping a single company, I’d mapped what I thought of as the key principles of the new software business model and the ecosystem of the companies that best exemplified those principles. I later did something similar in exploring what I came to call Web 2.0, trying to find the unifying principles that tied together the World Wide Web, file-sharing programs like Napster, distributed computation, and web services.

I called these meme maps. In them, I tried to represent both the canonical companies and the underlying principles defining a new wave in technology, creating a single unifying vision of a set of related technologies.

In a similar way, if we want to understand the implications of today’s technologies, one good way to start is by laying out the pieces of the jigsaw that we have, pieces we are convinced have something to do with each other, but it is not quite clear where and how they fit.

What are the canonical companies and technologies that seem to be at the forefront of today’s technology-driven changes to the economy? What do they teach us?

Google is still one of the key companies to understand. Its search engine is the pervasive neocortex of the information economy, a critical component of the global brain that the Internet has become, connecting billions of humans with the data and documents we collectively create. The principles that led me to make Google the poster child for Web 2.0 are still unfolding as drivers of the future: big data, algorithms, collective intelligence, software as a service, with the addition of a new focus on machine learning and AI. Understanding how algorithmic systems shape not just new services but also society is a central theme of this book.

The Android phone operating system puts Google’s services into the pockets of billions of people. The company kicked off the race for self-driving cars and has been a leader in their development. And it has big ambitions in areas like healthcare, logistics, the design of cities, and robotics. And last but not least, its advertising-based business model means that almost every service it creates can be given away for free, with implications we are only beginning to grasp.

If Google was the defining company of the information age, Facebook is the defining company of the social era. The application began simply as a way for students on college campuses to find and meet each other, passed through its adolescence as a way for friends and family to keep in touch, but now, with nearly two billion members, it has challenged Google as the master of collective intelligence, uncovering an alternate routing system by which content is discovered and shared. Like Google, Facebook has invested heavily in AI, and its successes and failures have much to teach us about what it can and can’t do. Contrasting the two companies teaches us something about how algorithmic systems work and how to manage them.

Amazon is also a force of nature. Jeff Bezos is arguably the greatest entrepreneur of the Internet era, reinventing industry after industry. Amazon started as an online bookseller but eventually came to dominate every aspect of online retail in the United States. Amazon also pioneered ebooks; with the Kindle it came to dominate that emerging market and gain channel control over the future of book publishing. It has become a leader in online entertainment of all kinds, rivaling Netflix as the next-generation movie and television studio. And with the Amazon Echo, it has become a force in bringing intelligent agents and AI into the consumer realm. But arguably the most important thing that Amazon did was to turn its e-commerce application into a cloud computing platform on which the bulk of Silicon Valley startups operate; as the cloud model has matured, large, established enterprises have migrated to it as well. The lessons of this business transformation alone could fill a book (and will be the subject of a later chapter in this one).

Apple led the generational shift from the personal computer to the smartphone, and from the web to mobile apps. The iPhone is the platform where most cutting-edge applications are first launched. While Apple’s flood of innovations seems to have slowed since the death of Steve Jobs, it remains a dominant player in the mobile market, and its design leadership continues to challenge us to “think different” about the possibilities of the future.

There are many other companies where WTF? technologies are being birthed and brought to market. Microsoft has been reinvigorated in recent years under the leadership of Satya Nadella, and its investments in AI and “cognitive services” for developers to use in their applications are bringing it into creative conflict with Facebook, Amazon, and Google. Chinese companies like Baidu, Tencent, and Alibaba are growing at the edge of our ken here in the United States, and may well be inventing futures that will overtake ours. And there is a host of startups, large and small, not to mention technologies that have yet to make it out of the labs or the dreams of their inventors.

Over the course of the next few chapters, we will see how lessons from each of these companies, and many others, overlap and come into focus as a map of the future.

In order to look for the common patterns, it is easiest to start with a map of one of the individual companies or technologies, draw out what key principles it demonstrates, and then tease out some of the common threads that tie it together with other WTF? technologies that delight, puzzle, or alarm us today. If we’ve drawn the map correctly, all of its components will show up in other companies that are building twenty-first-century services.

A BUSINESS MODEL MAP OF UBER AND LYFT

One company at the center of many emerging trends is Uber, a center it shares with Lyft, its biggest competitor in the United States; Didi Chuxing in China; and other on-demand car companies around the world.

Matt Cohler, an early Facebook employee turned venture capitalist who became an early investor in Uber, noted that the smartphone is becoming “a remote control for real life.” Uber and Lyft drive home the notion that the Internet is no longer just something that provides access to media content, but instead unlocks real-world services.

Uber began as so many startups do, not as a transformative big idea but just with an entrepreneur “scratching his own itch.” In 2008, Garrett Camp began to dream of a system for summoning limousines (“black cars”) on demand. He had made it big with the sale of his startup, Stumbleupon. He’d bought a nice car, but he didn’t like driving, and San Francisco’s notoriously deficient taxi system made it difficult for him to get around.

Over the next two years, Camp developed the idea, recruiting his friend Travis Kalanick, another successful entrepreneur, as a thought partner in the project. Camp originally planned to run his own fleet of on-demand limousines, but Kalanick argued against it. “Garrett brought the classy and I brought the efficiency,” Kalanick told Brad Stone in an interview. “We don’t own cars and we don’t hire drivers. We work with companies and individuals who do that. . . . I want to push a button and get a ride. That’s what it’s all about.”

When Uber was launched in the summer of 2010, it reflected the needs of its already-wealthy founders: “Everyone’s private driver.” It seemed to be a small niche, hardly world-changing. The service was offered in San Francisco only. Yet over the next few years, Uber developed into a force that transformed the market for on-demand transportation, and today it has more drivers providing services than the entire previous taxi and limousine industry. How did this happen?

The game changer came early in 2012 when two companies, Sidecar and Lyft, introduced a peer-to-peer model in which ordinary people, not just licensed limousine drivers, provided the service using their personal cars. It was this further innovation that reshaped the way we think about employment, with drivers who not only have no guaranteed work from the company, but also make no guarantees to the company about whether they will work when they are needed. Instead, a swarm of drivers are summoned and managed by algorithms that match drivers and passengers in a real-time online marketplace, with surge pricing to bring more drivers into the market when the algorithm determines that there are not enough of them to meet demand.

There are many historical examples of peer-to-peer public transportation. Zimride, Logan Green and John Zimmer’s predecessor to Lyft, was inspired by the informal jitney systems they observed in Zimbabwe. But using the smartphone to create a two-sided, real-time market in physical space was something profoundly new.

After initial skepticism, Uber copied the peer-to-peer model a year later. Driven by an aggressive CEO, a stronger technical focus on logistics and marketplace incentives, a take-no-prisoners corporate culture, and huge amounts of capital, it has spent billions to outpace its rivals. Lyft is still a strong contender in the United States, gaining, but in distant second place.

The amount of capital raised turned out to be surprisingly important. While the transportation network companies, or TNCs, as they are sometimes called, don’t have to spend money buying cars, they have spent billions on marketing, subsidized fares, and driver incentives in a race to build the biggest network of customers and drivers.

Uber’s willingness to sidestep regulators was also part of its success. Sidecar and Lyft spent time working with the California Public Utilities Commission to craft new rules to legitimize their novel approach. Even earlier, companies like Taxi Magic, founded in 2008, had simply worked within the existing taxicab industry and accepted its rules. Taxi Magic, which allowed you to summon a cab and pay with your smartphone, was integrated with existing taxi dispatch systems. And there the incentives to provide better service to customers were all wrong. The next available ride was offered to the driver who had been waiting the longest, not to the one who was closest to the passenger, and even then, during busy times, a driver might prefer to pick up people on the street. Cabulous, launched in 2009, also tried to work within the confines of the highly regulated taxicab industry.

In this regard, Camp and Kalanick’s start with high-end black cars was fortuitous. Limousines have fewer regulations than taxis (for example, they are able to set their own prices rather than having them be set by regulators), but they have one big regulatory limit. Unlike taxis, which can pick up passengers who hail them on the street, limousines must be scheduled in advance. With an app, though, “in advance” becomes a relative term. Drivers who previously had to wait around for a call suddenly found new opportunity with the app, and were eager to sign up. The incentives of passengers and drivers were aligned, drawing both into what would become a thriving marketplace.

The taxicab companies recognized relatively early on that the new app made limousines more competitive with taxis, and claimed that Uber was an unlicensed cab company. The company’s initial name, UberCab, gave fuel to the argument. But with the small concession of dropping “Cab” from the name (something they’d wanted to do anyway), Uber was able to convince regulators that they should still be covered by the rules of the limousine market rather than by those of taxicabs.

Once Uber added peer-to-peer service, it was game over for the taxicab industry, hobbled by its existing regulatory model, which controlled both the fares that could be charged and the number of people who could provide the service. Uber had become more than a service that made black cars competitive with taxis; it represented a whole new approach to urban transportation.

The ambition expressed in the Uber “origin story” on its website hints at the possibilities:

What started as an app to request premium black cars in a few metropolitan areas is now changing the logistical fabric of cities around the world. Whether it’s a ride, a sandwich, or a package, we use technology to give people what they want, when they want it.

For the women and men who drive with Uber, our app represents a flexible new way to earn money. For cities, we help strengthen local economies, improve access to transportation, and make streets safer. When you make transportation as reliable as running water, everyone benefits.

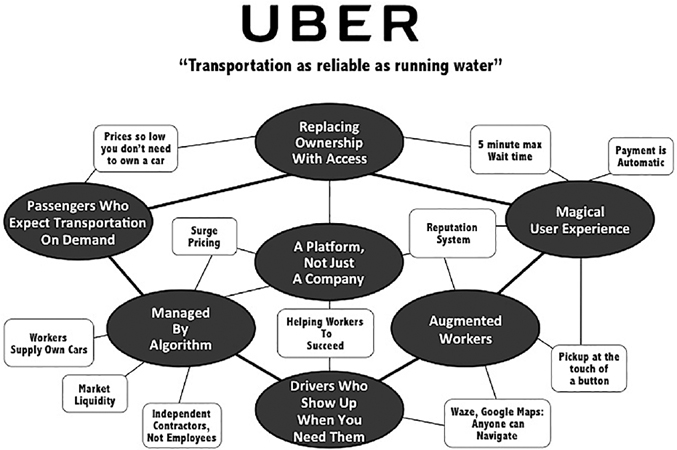

Here’s a possible business model map for Uber or Lyft like the one Dan and Meredith Beam drew for Southwest Airlines.

What are some of the core elements of this business model?

Replacing Ownership with Access. In the long run, Uber and Lyft are not competing with taxicab companies, but with car ownership. After all, if you can summon a car and driver at low cost via the touch of a button on your phone, why should you bother owning one at all, especially if you live in the city? Uber and Lyft do for car ownership what music services like Spotify did for music CDs, and Netflix and Amazon Prime did for DVDs. They are replacing ownership with access. “I tell people I live in LA like it’s New York. Uber and Lyft are my public transit station,” said one customer in Los Angeles.

Uber and Lyft also replace ownership with access for the companies themselves. Drivers provide their own cars, earning additional income from a resource they have already paid for that is often idle, or allowing them to help pay for a resource that they are then able to use in other parts of their lives. Meanwhile, Uber and Lyft avoid the capital expense of owning their own fleets of cars.

Passengers Who Expect Transportation On Demand. Much as Michael Schrage outlined in Who Do You Want Your Customers to Become?, Uber and Lyft are asking their consumers to become the kind of people who expect a car to be available as easily as they had previously come to expect access to online content. They are asking them to redraw their map of how the world works.

Uber and Lyft recognized early on that many young urban professionals had already given up on owning a car, but for their business to spread beyond major urban centers and wealthy demographics, they would need more people to accept this premise and make the switch. The reliability, convenience, and coverage offered by the application are not enough to achieve this ambition. That is what is behind Uber and Lyft’s quest for ever-lower prices. Prices must be so low that calling an Uber or Lyft is not just vastly more convenient than owning a car, but more affordable as well.

The Magical User Experience of pulling out a phone, tapping a button, and having a car and driver find you a few minutes later, a needle in the haystack of the city, gives confidence that it is possible to have control and availability without ownership. The WTF? moment of a brilliant new user experience is often the key to changing user behavior and turbocharging adoption. While Lyft introduced a revolutionary part of the on-demand transportation model, Uber was the first to put it all together into a seamless experience, beautiful and easy to use.

Drivers Who Show Up When You Need Them. Transportation on demand for passengers requires a critical mass of drivers. Uber’s original vision of black car drivers on demand served only a narrow slice of the potential market. As their ambitions grew, they needed a much larger supply of drivers, which the peer-to-peer model supplied.

Augmented Workers. GPS and automated dispatch technology inherently increase the supply of drivers because they make it possible for even part-time drivers to be successful at finding passengers and navigating to out-of-the-way locations. There was formerly an experience premium, whereby experienced taxi and limousine drivers knew the best way to reach a given destination or to avoid traffic. Now anyone equipped with a smartphone and the right applications has that same ability. “The Knowledge,” the test required to become a London taxi driver, is famously one of the most difficult exams in the world. The Knowledge is no longer required; it has been outsourced to an app. An Uber or Lyft driver is thus an “augmented worker.”

A Platform, Not Just a Company. A traditional business that wants to grow must hire people, invest in plants and equipment, and build out a management hierarchy. Instead, Uber and Lyft have created digital platforms to manage and deploy hundreds of thousands of independent drivers, trusting the marketplace itself to ensure that enough of them show up to work and bring their own equipment with them. (Imagine for a moment that Walmart or McDonald’s didn’t schedule their workers, but simply offered work, trusted enough people to show up, and offered higher wages when there weren’t enough workers to meet demand.) This is a radically different kind of corporate organization.

There are those who argue that Uber and Lyft are simply trying to avoid paying benefits by keeping their workers as independent contractors rather than as employees. It isn’t that simple. Yes, it does save them money, but independent-contractor status is also important to the scalability and flexibility of the model. Unlike taxis, which must be on the road full-time to earn enough to cover the driver’s daily rental fee, the Uber and Lyft model allows many more drivers to work part-time (and to take passenger requests simultaneously from both services), leading to an ebb and flow of supply that more naturally matches demand. More drivers means better availability for customers, shorter wait times, and far better geographic coverage. These companies are able to provide a five-minute response time over a far larger geographical area than traditional taxi and limousine companies.

Management by Algorithm is central to Uber and Lyft’s business. It would be impossible to marshal the workers, connect drivers and passengers in real time, automatically track and bill every ride, or provide quality control by letting the passengers rate their drivers, without the use of powerful computer algorithms. Creating and deploying these algorithms is the core of what the company does.

Every passenger is required to rate their driver after each trip; drivers also rate passengers. Drivers whose ratings fall below a certain level are dropped from the service. This can be a brutal management regime, but as political scientist Margaret Levi noted to me, from the point of view of passengers, the real-time reputation system acts as a kind of “private regulation” that outperforms traditional municipal taxi regulation in enforcing high standards of safety and customer experience.

Having enough drivers to meet demand is a marketplace management problem. Achieving “market liquidity”—enough drivers to ensure that passengers get picked up within only a few minutes, and enough passengers that drivers are willing to show up to work without being on the payroll—is a complex problem.

Unlike the taxi industry, which creates an artificial scarcity by issuing a limited number of “medallions,” Uber and Lyft use market mechanisms to find the optimum number of drivers, with an algorithm that raises prices if there are not enough drivers on the road in a particular location or at a particular time. While customers initially complained, using market forces to balance the competing desires of buyers and sellers has helped Uber and Lyft to achieve an equilibrium of supply and demand in close to real time.

There are other signals in addition to surge pricing that Uber and Lyft use to tell drivers that more (or fewer) of them are needed. Incentives to drivers, especially when entering new cities, has been one reason why Uber and Lyft have had to spend so much money to enter new markets. There are those who equate this behavior to dumping—selling goods and services below cost in order to dominate the market and drive out other sellers, only to raise prices once a monopoly position is earned. They argue that raising prices or cutting the driver’s share of earnings is the only way these companies will ever make money.

But from the point of view of Uber and Lyft, driving down cost is a way to grow the market to the point where the critical mass of buyers and sellers becomes self-sustaining, which will lower the cost of customer and driver acquisition. As prices get lower, new demand opens up. How many people could afford a car on demand when they were a luxury of the superrich? How many people take for granted today that they can have a car waiting whenever they need it? How many might take this for granted in a future where the cost of these services continues to come down?

The biggest strategic question in my mind is how Uber and Lyft deal with the problem of driver turnover. Are the wages and working conditions sufficient to achieve a steady-state supply of drivers or are they simply burning through a limited supply of people who try working for the service and then find other, better work? What happens when they stop providing incentives beyond the fare for drivers to sign up, to work more trips each week, or to commit to working only for one platform rather than offering their services through both? Drivers are already complaining that they are being bankrupted by fare cuts and diminished incentives.

The outcome of the contention between these platforms and labor regulators about working conditions and employment status could also play a decisive role in the success or failure of these platforms, as could disputes with traditional taxi and limousine licensing regimes, because labor regulators could, without understanding how all the pieces of the model fit together, place restrictions on these services that make it impossible for their business model to work.

One of the most important functions of a business model map is that it helps you understand how all of the pieces of a business fit together. Many taxi companies, late to the game, are now introducing apps that superficially have many of the same features as Lyft and Uber. But they are often unable to meet the expectations for price and availability that Uber and Lyft have established because they don’t have a liquid marketplace. They offer a fixed number of cars and drivers, limited by city taxi licenses (medallions) and associated costs, so the supply of cars is inevitably less than is needed at times of peak demand. If they had enough cars for quick, reliable pickup at the busiest times, those cars would inevitably be idle at other times. It is no accident that a majority of Uber and Lyft drivers are part-time; it is one of the intrinsic advantages of the model that supply rises to meet demand and slacks off when demand is less.

The regulatory friction of the traditional approach makes taxi costs higher and availability worse. Uber and Lyft drivers routinely make more money per hour than taxi drivers; meanwhile, customers generally have better experiences and lower prices. Those who complain that Uber and Lyft “aren’t following the rules” need to ask whether those rules are achieving their intended objective.

That doesn’t mean that Lyft and Uber should get a free pass on providing employee benefits and labor protections. As we’ll see in Chapter 9, the right answer is to develop a social safety net and regulatory frameworks as flexible and responsive as the on-demand business model itself. Uber and Lyft (and Airbnb) have taken the approach of asking for forgiveness rather than permission for many of their innovations, relying on swift consumer adoption to give them allies against regulators. There’s no question, though, that some kind of accommodation with regulators is in the future for all of these companies. They would be wise to get ahead of the problem with regulatory proposals as innovative as their business model.

MAKING STRATEGIC CHOICES

You can tell if a business model map is good if it helps a company to make sound strategic choices. That is, it frames the problem in such a way that a company can make conscious choices about what’s important, rather than discovering too late that it broke a key part of what had made it successful.

For example, Uber and Lyft have made much of their plans to incorporate self-driving cars into their future. With a shallow understanding of their business, you might quickly conclude that the reason to do this is that eliminating the 70–80% of the fare that is paid out to drivers will make these businesses more profitable.

With the aid of the business model map I outlined above, you’d ask different questions. If the company currently depends on a liquid marketplace of drivers who bring their own cars and work only when they believe they can make a decent wage, what happens when the platforms introduce self-driving cars into the mix? They potentially destabilize their own marketplace.

There will be significant costs to achieve the kind of availability for passengers that Uber or Lyft currently have using centrally owned self-driving cars. Remember that the total number of cars in the system must be sufficient to satisfy peak demand.

If the company itself owns the self-driving cars, and uses them to compete with its human drivers for the busiest, most lucrative times, it risks making them less willing to participate. If the goal is truly to make transportation as reliable as running water or electricity, rather than simply to maximize company profit, these companies should deploy self-driving cars not to compete with their drivers but to supplement them, providing services in areas that are currently not well served, even though those cars might be utilized less often. More likely, the right answer will be to tune their mathematical models and algorithms to find the optimum mix of human and machine, in the same way that the electrical grid relies on coal, natural gas, or nuclear power for “base load” while meeting peak daytime demand with renewables.

In order to maintain the benefits of the marketplace model, rather than deploying self-driving cars itself, Uber or Lyft might instead create incentives for its drivers to purchase them and make them available to the company. In many ways, this would change their business model to one closer to that of Airbnb, in which the participants in the marketplace provide an asset they own rather than their labor. But for this plan to work, Uber or Lyft would not need to develop their own autonomous vehicles, but instead could promote interoperability between different autonomous vehicle vendors. If the plan is something like “Buy your autonomous Tesla, drive it to work, and then let us use it for the rest of the day,” it would imply a mixed fleet of vehicles, requiring investments in interoperable control and dispatch. (Tesla seems to have other plans, though, forbidding their drivers from using their cars for Uber and Lyft, with the intention of rolling out its own competing service. A business model does not exist in isolation; it must adapt to the competition as well as to the needs of its customers and suppliers.)

This discussion is also important for policy makers. A world of interoperable self-driving cars would provide an opportunity for current on-demand drivers—or, in a future world of self-driving trucks, independent truckers—to participate in the marketplace as owner-operators; a world in which a company like Tesla is able to limit the ability of its car owners to drive for any competing service reduces the drivers to a real-world version of what author Nicholas Carr has called “digital sharecroppers.” Ensuring interoperability of self-driving cars is as important as was the original interoperability that drove the Internet revolution. Open standards in this area will help ordinary people, not just big companies, to reap the benefits of the next wave of automation.

Betsy Masiello, who works in public policy at Uber, responded to my questions on how the peer-to-peer model might mix with autonomous vehicles by saying that right now, people think of Uber as a replacement for taxis; perhaps instead, it will end up closer to peer-to-peer fractional car rental. It is likely that the reality will be a mix of both.

Finally, if the augmented worker is indeed central to Uber and Lyft’s business model, perhaps the right way to think about self-driving cars is as a further augmentation, enabling new kinds of services. Once driving itself is a commodity fulfilled cheaply by machines, what will the humans who are now augmented by that capability find to do with their new superpower? What possibilities are there for society when transportation is as cheap and reliable as running water?

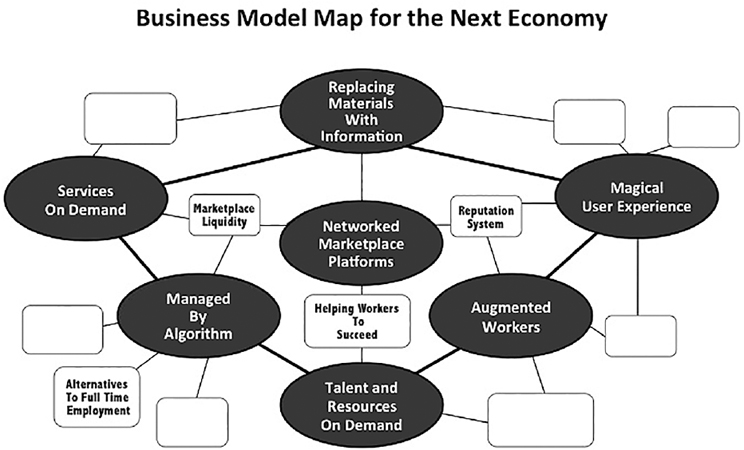

A BUSINESS MODEL MAP FOR THE NEXT ECONOMY

When building a map that tries to capture the essence of multiple companies, it’s important to recognize that neat categorization is a fool’s errand. For example, like Uber and Lyft, Airbnb is a networked marketplace, but it’s a network of apartments, homes, and rooms, and only secondarily the network of workers who clean up after a guest has come and gone. Google and Facebook are networks of people who produce, share, and consume content, and the advertisers who want to reach them. The iPhone or Google Play app store enhances a physical device with a network of apps and the ecosystem of developers who create them.

Distributed solar power generation, electric vehicles, and other signs of the transition from carbon-based energy to renewables seem like they are a bit out of the frame—or are they? After all, rooftop solar shares many of the distributed network characteristics of on-demand companies like Uber and Airbnb.

When making sense of the future, think in terms of gravitational cores, not hard boundaries. Just as the sun’s gravity well reaches out beyond the orbit of Pluto and encompasses not just the planets in the ecliptic but comets and planetoids with eccentric orbits, so too the forces shaping the future all have a gravitational core and a gradually attenuating influence. And just as the solar system has multiple gravitational subsystems, where the draw of the local giant keeps its own satellites in tow while all still partake in the larger dance, these interpenetrating trends influence each other and converge.

With that in mind, let’s consider a generalized version of the Uber/Lyft map, which I’ve labeled below as the “Business Model Map for the Next Economy.” I’ve intentionally left some of the boxes for contributing factors blank, so that you can think about how you might fill them in for your own company, or for the services you consume. I’ve left a few of them filled in, because they seem central to the futures that are unfolding.

Replacing Materials with Information. Giving physical assets a digital footprint allows them to be managed much more like information assets. I picked up this notion from Liam Casey, an Irish expat who runs PCH International, a design and logistics company for the electronics industry, from offices in Shenzhen, San Francisco, and Ireland. PCH provides direct-to-consumer just-in-time manufacturing for consumer electronics vendors, allowing them to take orders online that are shipped directly from China.

“We replace inventory with information,” Liam said to me, showing me how his company’s inventory for US customers, where he has real-time data systems, is far less than it is for Australia, where he is reliant on keeping inventory in local warehouses, even though the Australian market is orders of magnitude smaller.

I heard a related comment from my son-in-law Saul Griffith, an inventor whose company, Otherlab, develops innovative technology approaches under contracts from DARPA (Defense Advanced Research Projects Agency), NASA, the National Institutes of Health (NIH), and the US Department of Energy. “We replace materials with math,” Saul told me, describing how the essence of many of his projects is computational design, understanding the nature of shapes and materials and computing how to use them more efficiently.

Saul pointed out how replacing materials with information could play out with autonomous cars. Most cars doubled in weight from 1960 to 2010. We made them safer by adding crumple zones and airbags and all sorts of clever features useful in accidents. We did not make spectacular gains in fuel economy even though engines became more efficient, because most cars got fatter—larger and heavier.

“What would happen,” he asked, “if we made cars so smart, and so automated, that they never hit each other? This is biology’s approach to safety. Jump out of the way or avoid the collision altogether. If we did so, we could lighten our cars up again, significantly so, which would have positive benefits on making it easier to electrify them. We could easily reduce the energy consumed in the transportation sector by two-thirds or more.”

“Replacing materials with information” is a more powerful formulation than “replacing ownership with access.” Yes, there is continuity between subscription models for on-demand media access and what is happening with services like Uber and Airbnb, but stating the principle more broadly allows us to understand even more of the modern world.

When you hear a new concept like this, succinctly stated, add it to your mental toolbox. Try it on as a way of seeing the world around you. How does it help you think differently?

Might this principle even reverse the logic of labor globalization? In a recent paper, economists Laura Tyson and Michael Spence point out that for the last several decades, the logic of globalization was that manufacturing moved toward the lowest-cost sources of labor. But now, they note, as “digital-capital-intensive technologies are substituting for humans in the routine labor-intensive parts of manufacturing supply chains . . . and digital technologies make manufacturing mobile with little or no cost penalty, physical manufacturing activity will move toward market demand rather than toward labor, because there are efficiencies to be gained from proximity to the market.”

Networked Marketplace Platforms. Not just Uber and Lyft, but Google, Facebook, Amazon, YouTube, Twitter, Snap, Baidu, Tencent, and Apple draw a great deal of their strength from the fact that they are networked marketplace platforms, managed by algorithm. As we’ll discuss in Chapter 5, they have some fundamental differences from the twentieth-century organizations with which they compete.

Might networks and technology platforms provide a new form of organization that trumps old corporate forms, replacing them with something even more powerful?

On Demand. It’s easy to put a platform like TaskRabbit, whose app allows consumers to hire occasional labor such as movers, house cleaners, or gardeners at the touch of a button, into the same map as Uber and Lyft. Even Upwork, which lets you tap into a global marketplace of professional programmers, designers, and other skilled workers for short-term “gigs,” is a clear fit. For many observers of the next economy, the map begins and ends there. But what can we call Amazon but an on-demand company, when increasingly its products are delivered same-day (sometimes even by a network of on-demand drivers in their own cars rather than by traditional package delivery companies)? What does on-demand become when companies around the world are experimenting with delivery by autonomous drone, and when Amazon’s automated warehouses require only a minute of human labor per package, with most of the work being done by a complex ballet of software and machines?

On-demand delivery is an example of how WTF? services introduced by tech companies become, like Tom Stoppard’s unicorn, “as thin as reality,” the stuff of ordinary life. On demand is becoming a universal consumer expectation. Amazon offered fast, “free” shipping, and now it’s hard for any big retailer to compete without offering the same.

Note that there are two ovals in the diagram representing on demand: services on demand and talent and resources on demand. On demand affects both sides of the networked marketplace.

Managed by Algorithm. The algorithms at the heart of a company like Uber or Lyft are computationally intensive, just like the algorithms at the heart of search engines, social networks, and financial markets. In many cases, the company with the best math wins. The cutting edge of smart algorithms is, of course, artificial intelligence, but AI is on a continuum with many other algorithmic systems, increasingly automated, that we already rely on in the modern world.

Understanding how algorithmic systems shape our society is a central theme of this book. To have a chance at making a better future for ourselves and our children, we must grasp not only how the nature of these algorithms is changing, but also why the algorithms we have most to fear may not be those of artificial intelligence but the unexamined algorithms that rule our economy. We will take up this question in Part III of this book.

Augmented Workers. The wonders of the first industrial revolution were brought about by workers partnered with new kinds of machines. Could we build skyscrapers or fly through the air or feed seven billion people without machines that make us stronger, faster, and more powerful? So too it is with today’s technology. If it is being deployed correctly, it should allow us to do things that were previously impossible.

The amount of augmentation may vary. A service like TaskRabbit augments workers’ ability to find customers, but not to do the job. Uber and Lyft drivers have additional augmentation in their ability to navigate and find clients. Surgeons and oncologists might be working in traditional organizations but are cognitively augmented workers, with “senses” that were not available to their forebears; so too, with the advent of augmented reality, will be building inspectors, architects, and factory workers.

To make the future economy better than the present, find new ways to augment workers, giving them new skills and access to new opportunities. As we automate something that humans used to do, how can we augment them so that they can do something newly valuable?

The idea that Uber teaches us that augmenting workers and helping them to succeed is an essential feature of companies looking to prosper in the next economy might create some cognitive dissonance for readers who have read about Uber’s abrasive, driven, former CEO, Travis Kalanick. In early 2017, Uber was rocked by a viral video that showed Kalanick berating a driver who told him that he had gone bankrupt because of Uber’s falling prices. “Some people don’t like to take responsibility for their own shit. They blame everything in their life on somebody else,” Kalanick burst out, in clear echo of Ayn Rand’s philosophy of unfettered self-interest. This is not the behavior of someone who places a high value on the humans who make the business work.

When trying to map the future, remember that the territory is not an idealized landscape, but a real one, full of contradiction. The people who are creating the future are complex, each with a mix of brilliance and flaws. They see some things we don’t, and are blind to others.

Just as I predicted in 1998 that Microsoft would one day embrace open source software (they did), I predict that Uber will one day come to realize that people are a critical component of what it has built, and make supporting them central to its competitive strategy. Lyft already knows this and uses it to its advantage.

It is also important to understand our role as customers in holding companies accountable for creating the future we want. Every time a PR crisis erupts, some of Uber’s customers desert it for Lyft, but most stick around. If you want a human-centered future, support companies that demonstrate human-centered values.

Magical User Experiences. The magic goes away, we know, but its presence is a sure test of impact. That WTF? moment tells us that we are looking through a door into the future. But who opened the door, and how?

Steve Jobs, who was a master at throwing that door wide open, said, “When you grow up you tend to get told that the world is the way it is. . . . Life can be much broader once you discover one simple fact: Everything around you that you call life was made up by people that were no smarter than you. And you can change it, you can influence it. . . . Once you learn that, you’ll never be the same again.”

Get WTF?: What's the Future and Why It's Up to Us now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.