16

WORK ON STUFF THAT MATTERS

WHEN CLAYTON CHRISTENSEN INTRODUCED THE TERM DISRUPTIVE technology in his 1997 business classic, The Innovator’s Dilemma, he asked a very different question than “How can I get funded by convincing VCs that there’s a huge market I can blow up?” He wanted to know why existing companies fail to take advantage of new opportunities. He discovered that breakthrough technologies that are not yet mature first succeed by finding radically new markets, and only later disrupt existing markets.

When I first met Clay in person, at Matt Asay and Bryce Roberts’s Open Source Business Conference in 2004, he retold the story of how RCA had spent billions of dollars in current value trying without success to make the radio and television sound quality of transistors as good as that of vacuum tubes. Sony’s brilliant business innovation wasn’t to improve the transistor—that came later. It was to find a market—portable radios, initially only for young people—where the quality didn’t matter as much as low price and the previously unattainable possibility of a radio that you could carry around with you.

The point of a disruptive technology is not the market or the competitors that it destroys. It is the new markets and the new possibilities that it creates. Just like transistor radios or the early World Wide Web, these new markets are often too small for established companies to consider them worth pursuing. By the time they wake up, an upstart has taken a leadership position in the emerging segment.

This was true of Microsoft, of Google, Facebook, and Amazon, and it is also true of current disruptors like Uber, Lyft, and Airbnb or the researchers who are taking us pell-mell into a future of self-driving cars and other applications of artificial intelligence. They started out trying to solve a problem.

I spend a lot of time urging Silicon Valley entrepreneurs to forget about disruption, and instead to work on stuff that matters. What do I mean by that? There are a number of litmus tests that I’ve learned by watching innovators in science and in open source software and the Internet, and that I try to pass on to young entrepreneurs. Here’s what I like to tell them.

1. WORK ON SOMETHING THAT MATTERS TO YOU MORE THAN MONEY.

Remember that financial success is not the only goal or the only measure of achievement. It’s easy to get caught up in the heady buzz of making money. You should regard money as fuel for what you really want to do, not as a goal in and of itself.

Money is like gas in the car—you need to pay attention or you’ll end up on the side of the road—but a successful business or a well-lived life is not a tour of gas stations.

Whatever you do, think about what you really value. If you’re an entrepreneur, the time you spend thinking about your values will help you build a better company. If you’re going to work for someone else, the time you spend understanding your values will help you find the right kind of company or institution to work for, and when you find it, to do a better job.

Don’t be afraid to think big. Business author Jim Collins said that great companies have “big hairy audacious goals.” Google’s motto, “access to all the world’s information,” is an example of such a goal. I like to think that my own company’s mission, “changing the world by spreading the knowledge of innovators,” is also such a goal. Nick Hanauer likes to say, “Solve the biggest problem you can.”

Pursue something so important that even if you fail, the world is better off for you having tried.

There’s a wonderful poem by Rainer Maria Rilke that retells the biblical story of Jacob wrestling with an angel, being defeated, but coming away stronger from the fight. It ends with an exhortation that goes something like this: “What we fight with is so small, and when we win, it makes us small. What we want is to be defeated, decisively, by successively greater beings.”

One test of a bubble is how many entrepreneurs are focused on their upcoming payday rather than on the big things they hope to accomplish. Me-too products are almost always payday-focused; the entrepreneurs who first made the market often had much less expectation of easy success, and were instead wrestling, like Jacob with the angel, with a hard problem that they weren’t even sure that they could solve, but that they believed they could at the very least make a dent in. Those who follow are too often just trying to cash in.

The most successful companies treat success as a by-product of achieving their real goal, which is always something bigger and more important than they are. Satya Nadella, the CEO of Microsoft, makes the same point when talking about the opportunity for AI. “The challenge will be to define the grand, inspiring social purpose for which AI is destined,” he writes. “In 1969, when President Kennedy committed America to landing on the moon before the end of the decade, the goal was chosen in large part due to the immense technical challenges it posed and the global collaboration it demanded. In similar fashion, we need to set a goal for AI that is sufficiently bold and ambitious, one that goes beyond anything that can be achieved through incremental improvements to current technology.”

When I asked Satya for an example of what he meant, he spoke movingly of his disabled son. “I have a special needs kid, and he’s locked in, and so I always think, ‘Wow, if only he could speak.’ And I think about what a brain-machine connection could do. Someone who’s got visual impairment could see or someone who’s got dyslexia could read. This is finally that technology that truly brings inclusiveness.”

Former Google executive Jeff Huber is also chasing this kind of bold dream of using technology to make transformative advances in healthcare. Jeff’s wife died unexpectedly of an aggressive, undetected cancer. After doing everything possible to save her and failing, he committed himself to making sure that no one else has that same experience. He has raised more than $100 million from investors in the quest to develop an early-detection blood test for cancer. That is the right way to use capital markets. Enriching investors, if it happens, will be a by-product of what he does, not his goal. He is harnessing all the power of money and technology to do something that today is impossible. The name of his company—Grail—is a conscious testament to the difficulty of the task. Jeff is wrestling with the angel.

2. CREATE MORE VALUE THAN YOU CAPTURE.

It’s pretty easy to see that a financial fraud like Bernie Madoff wasn’t following this rule, and neither were the titans of Wall Street who ended up giving out billions of dollars in bonuses to themselves while wrecking the world economy. But most businesses that prosper do create value for their communities and their customers as well as themselves, and the most successful businesses do so in part by creating a self-reinforcing value loop with and for others. They build or are part of a platform on which people who don’t work directly for them can build their own dreams.

Investors as well as entrepreneurs must be focused on creating more value than they capture. A bank that loans money to a small business sees that business grow, perhaps borrow more money, hire employees who make deposits and take out loans, and so on. An investor who bets on the future of an unproven technology can do the same. The power of this cycle to lift people out of poverty has been demonstrated for centuries.

If you’re succeeding at the goal of creating more value than you capture, you may sometimes find that others have made more of your ideas than you have yourself. It’s okay. I’ve had more than one billionaire (and an awful lot of startups who hope to follow in their footsteps) tell me how they got their start with a couple of O’Reilly books. I’ve had entrepreneurs tell me that they got the idea for their company from something I’ve said or written. That’s a good thing. I remember back in the early days of the Internet, when Carla Bayha, the computer book buyer at Borders, told me after one of my talks, “Well, you’ve just given your competitors their publishing program for the year.”

If my goal is really “changing the world by spreading the knowledge of innovators,” I’m thrilled when my competitors jump on the bandwagon and help me spread the word.

Look around you: How many people do you employ in fulfilling jobs? How many customers use your products to make their own living? How many competitors have you enabled? How many people have you touched who gave you nothing back?

There’s a wonderful section in Victor Hugo’s brilliant, humane novel Les Misérables about the good that his protagonist Jean Valjean does as a businessman (operating under the pseudonym of Father Madeleine since he is an escaped convict). Through his industry and vision, he makes an entire region prosperous, so that “there was no pocket so obscure that it had not a little money in it; no dwelling so lowly that there was not some little joy within it.” And the key point: “Father Madeleine made his fortune; but a singular thing in a simple man of business, it did not seem as though that were his chief care. He appeared to be thinking much of others, and little of himself.”

Focusing on solving big problems rather than on making money, and focusing on creating more value than you capture, are closely related principles. The first one is a test that applies to those starting something new; the second is the harder test that you must pass in order to create something enduring.

3. TAKE THE LONG VIEW.

The musician Brian Eno tells a story about the experience that led him to conceive of the ideas that evolved into the Long Now Foundation, a group that works to encourage long-term thinking. In 1978, Brian was invited to a rich acquaintance’s housewarming party, and as the neighborhood his cab drove through became dingier and dingier, he began to wonder if he was in the right place. “Finally [the cab driver] stopped at the doorway of a gloomy, unwelcoming industrial building,” he writes. “Two winos were crumpled on the steps, oblivious. There was no other sign of life in the whole street.”

But he was at the right address, and when he stepped out on the top floor, he discovered a multimillion-dollar palace.

“I just didn’t understand,” he explains. “Why would anyone spend so much money building a place like that in a neighbourhood like this? Later I got into conversation with the hostess. ‘Do you like it here?’ I asked. ‘It’s the best place I’ve ever lived,’ she replied. ‘But I mean, you know, is it an interesting neighbourhood?’ ‘Oh—the neighbourhood? Well . . . that’s outside!’ she laughed.”

In the talk many years ago where I first heard him tell this story, Brian went on to describe the friend’s apartment, the space she controlled, as “the small here,” and the space outside, full of winos and derelicts, as “the big here.” He went on from there, along with others, to come up with the analogous concept of the Long Now. We need to think about the long now and the big here, or one day our society will enjoy neither.

It’s very easy to make local optimizations, but they eventually catch up with you. Our economy has many elements of a Ponzi scheme. We borrow from other countries to finance our consumption, and we borrow from our children by saddling them with debt, using up nonrenewable resources, and failing to confront great challenges in income inequality, climate change, and global health.

Every new company trying to invent the future has to think long-term. What happens to the suppliers whose profit margins are squeezed by Walmart or Amazon? Are the lower margins offset by higher sales or do the suppliers faced with lower margins eventually go out of business or lack the resources to come up with innovative new products? What happens to driver income when Uber or Lyft cut prices for consumers in an attempt to displace competitors? Who will buy the products of companies that no longer pay workers to create them?

Walter Reuther, the pioneer UAW organizer, told the story of a conversation with a Ford executive who was showing Reuther his new factory robots. “How are you going to collect union dues from all these machines?” he asked. Reuther said he replied, “You know, that is not what’s bothering me. I’m troubled by the problem of how to sell automobiles to them.” The question of who will have the money to buy tomorrow’s products in an increasingly automated world should be central to every entrepreneur’s thinking.

It’s essential to get beyond the idea that the only goal of business is to make money for its shareholders. I’m a strong believer in the social value of business done right. We should aim to build an economy in which the important things are a natural outcome of the way we do business, paid for in self-sustaining ways rather than as charities to be funded out of the goodness of our hearts. Pierre Omidyar, the founder of eBay who went on to become a pioneer in what is now sometimes called “West Coast philanthropy,” which uses both traditional charitable giving and strategic startup investing as tools toward the same social goals, once told me, “I invest in businesses that can only do well by doing good.”

Whether we work explicitly on causes and the public good, or work to improve our society by building a business, it’s important to think about the big picture, and what matters not just to us, but to building a sustainable economy in a sustainable world.

4. ASPIRE TO BE BETTER TOMORROW THAN YOU ARE TODAY.

I’ve always loved the judgment of Kurt Vonnegut’s novel Mother Night: “We are what we pretend to be, so we must be careful about what we pretend to be.” This novel about the postwar trial of a Nazi propaganda minister who was secretly a double agent for the Allies should serve as a warning to those (politicians, pundits, and business leaders alike) who appeal to people’s worst instincts but console themselves with the thought that the manipulation is for a good cause.

But I’ve always thought that the converse of Vonnegut’s admonition is also true: Pretending to be better than we are can be a way of setting the bar higher, not just for ourselves but for those around us.

People have a deep hunger for idealism. The best entrepreneurs have the courage that comes from aspiration, and everyone around them responds to it. Idealism doesn’t mean following unrealistic dreams. It means appealing to what Abraham Lincoln so famously called “the better angels of our nature.”

That has always been a key component of the American dream: We are living up to an ideal. The world has looked to us for leadership not just because of our material wealth and technological prowess, but because we have painted a picture of what we are striving to become.

If we are to lead the world into a better future, we must first dream of it.

DEVELOPING A ROBUST STRATEGY

The future is fundamentally uncertain. No matter how hard we try to map the future, we will be surprised. As Hamlet said, “The readiness is all.”

Fortunately, there’s actually a management discipline designed specifically to address this issue. It’s called scenario planning. Scenario planning takes for granted that the future is uncertain. But it also notes that there are deep trends shaping the future that we can observe and take into account. Some of them are fairly certain—population growth and demographics, for instance, or for many years, technological trends like Moore’s Law—while others, such as political elections, technology innovation, and terrorist attacks, constantly surprise us.

Even in the areas where we are surprised, in retrospect we often realize we could have seen changes coming. World War I followed what was widely regarded as “the perfect summer” at the height of the British Empire’s success. A mad assassin lit the fuse but the kegs of powder had been set in place by decades of bad decisions by the great powers. The near collapse of the world economy in 2008 as a result of financial industry excesses happened while Ben Bernanke, an expert on the 1929 stock market crash and its aftermath, who should have known better, was chairman of the Federal Reserve.

Scenario planning takes for granted that it is hard for human beings to imagine the future as being radically different from the present. As a result, its practitioners don’t try to predict the future; they work to prepare companies and countries to develop “robust strategies” that work in the face of radically different futures.

The goal is not to identify what will happen, but to stretch the mind to think about what might happen. A scenario-planning exercise therefore asks participants to imagine four radically different futures that could come about as a result of current trends. As Peter Schwartz, one of the originators of the technique, wrote in the introduction to his book about it, The Art of the Long View, the scenario is “a vehicle . . . for an imaginative leap into the future.”

The first step is to identify some key vectors that may influence the future. Remember, a vector is defined in mathematics as a quantity that can only be fully described by both a magnitude and a direction.

It’s worth noting that both velocity and acceleration are vectors. But velocity is the speed that something is going in a particular direction, while acceleration is the rate of increase in speed. Trends that are accelerating are especially worth taking note of. One mistake many entrepreneurs and investors make is to look at the size of something, decide that it’s “big” or inevitable, and go all in on it. But of course, it’s often much more useful to recognize something when it’s small, and growing fast.

There are many trends that are big and inevitable, but growing more slowly than the entrepreneurial time horizon. Others are growing too fast. That’s why one of the measures that we’ve tried to use at O’Reilly Media in looking at emerging technologies or other trends is the rate of change. A robust strategy has to take your own resources and time horizon into account. Sunil Paul was a victim of this problem. He correctly identified a huge opportunity, but at first it wasn’t happening fast enough, and then later, it was moving so fast he couldn’t catch up to it.

Bill Gates once wrote, “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.” That was true of Microsoft itself. Despite Gates’s warning (in the 1996 afterword to the revised edition of his book The Road Ahead, which had been updated to repair the omission of the Internet from the first edition a year earlier) and despite massive efforts to catch up, Microsoft missed the Internet wave and was surpassed by companies with radically new technology and business models.

In a scenario-planning exercise, the vectors are drawn in such a way that they cross each other and divide the possibility space into quadrants. Those quadrants are the basis for four scenarios, typically developed over a period of days by a small group of company executives, military planners, or government policy makers together with a set of invited experts.

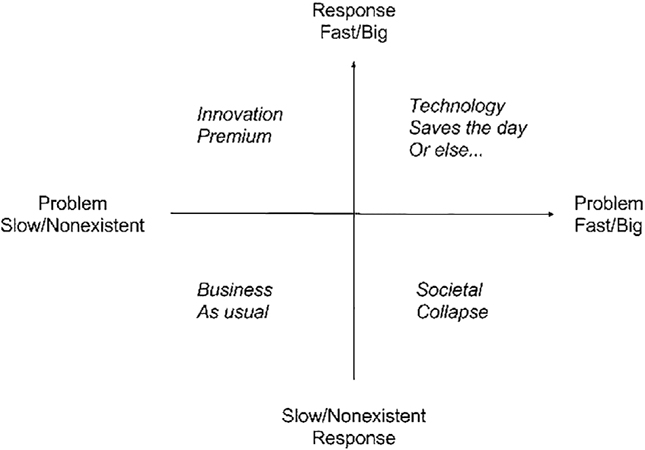

Let me illustrate the technique by imagining what such an exercise might look like at an energy industry company faced with the possibility of human-caused climate change.

There has been for many decades fairly incontrovertible scientific evidence that anthropogenic climate change is a reality. But for the purposes of this example, let’s assume that instead, it remains one of the critical uncertainties. After all, one major political party in the United States has staked its policies on the notion that anthropogenic climate change is a hoax. And even if it is not a hoax, the magnitude and speed of the change remains unclear even in our best climate models.

So let the first uncertainty vector be whether or not potentially catastrophic anthropogenic climate change is happening, how fast it goes, and how bad it gets.

Let the second vector be the magnitude and urgency of humanity’s response to the problem, and our ability to come up with ingenious solutions to it in time to make a difference.

You might end up with a quadrant map that looks like the one shown in the figure below:

It seems apparent that if you’re a businessperson thinking through these scenarios, the “robust strategy” is to assume that climate change is happening, and to respond. In the lower half of the scenario quadrant, we see no opportunity—it’s either business as usual, or societal collapse. In the upper half, there is business opportunity whether the climate scientists or the skeptics are correct.

What makes the strategy robust is that we don’t need to be sure that the worst fears of climate scientists are correct in order to act. The strategy is a good one even if they are wrong.

Climate change provides us with a modern version of Pascal’s Wager (the argument of the seventeenth-century philosopher and mathematician for acting as though you believe in God even if you don’t). If catastrophic global warming turns out not to happen, the steps we’d take to address it are still worthwhile. Given that there’s even a reasonable risk of disruptive climate change, any sensible person should decide to act. It’s insurance. The risk of your house burning down is small, yet you carry homeowner’s insurance; you don’t expect to total your car, but you know that the risk is there, and again, most people carry insurance; you don’t expect catastrophic illness to strike you down, but again, you invest in insurance.

If there is no human-caused climate change, or the consequences are not dire, and we’ve made big investments to avert it, what’s the worst that happens? In order to deal with climate change:

• We’ve made major investments in renewable energy, which pay off handsomely to those who make them.

• We’ve invested in a potent new source of jobs.

• We’ve improved our national security by reducing our dependence on oil from hostile or unstable regions.

• We’ve mitigated the enormous economic losses from pollution. (China has estimated these losses to its economy as 10% of GDP.) We currently subsidize fossil fuels in dozens of ways, by allowing power companies, auto companies, and others to keep environmental costs “off the books,” by funding the infrastructure for autos via fuel taxes while demanding that railroads and other forms of public transportation pay for their own infrastructure, and so on.

• We’ve renewed our industrial base, investing in new industries rather than propping up old ones. Climate critics like to cite the cost of dealing with global warming. But the costs are similar to the “costs” incurred by record companies in the switch to digital music distribution, or the costs to newspapers implicit in the rise of the web. That is, they are costs to existing industries, but ignore the opportunities for new industries that exploit the new technology. I have yet to see a convincing case made that the costs of dealing with climate change aren’t principally the costs of protecting incumbent industries.

By contrast, let’s assume that the climate skeptics are wrong. We face the displacement of hundreds of millions of people, droughts, floods and other extreme weather, species loss, and economic harm that will make us long for the good old days of the 2008 financial industry meltdown.

It really is like Pascal’s Wager. On one side, the worst outcome is that we’ve built a more robust innovation economy. On the other side, the worst outcome truly is hell. In short, we do better if we believe in climate change and act on that belief, even if we turn out to be wrong.

That’s what scenario planners mean by a “robust strategy.”

I doubt that Elon Musk did a conscious scenario-planning exercise, but all of his business decisions are consistent with the model above. Tesla, SolarCity, and SpaceX have all turned out to be robust business opportunities even though the worst ravages of climate change have not yet hit us. Musk’s leadership in electric vehicles, rooftop solar, and human space exploration have all been bets worth placing. Similarly, countries such as China that invested heavily in solar energy have built huge new industries. Germany and Scandinavia are far ahead in decoupling their economies from fossil fuels. The United States, which largely chose the “business as usual” scenario, has lagged behind.

This may be about to change, if we can move beyond the old left–right divide on the issue. The Climate Leadership Council, an organization led by a Who’s Who of conservative economists and former government and business leaders, recently came out with a report titled “The Conservative Case for Carbon Dividends,” calling for a carbon tax whose proceeds would be rebated directly to all Americans, as a kind of citizen’s dividend similar to those discussed in the previous chapter. So many of our problems come from being stuck in a bad map that we are unwilling to rewrite, even though it’s clear that it no longer matches reality.

There is enormous opportunity in transforming our energy economy. My son-in-law, energy researcher and inventor Saul Griffith, has drawn a massive Sankey diagram—a map of all the energy sources and uses in the US economy to a resolution better than 1%. Standing next to the map, he explains to a visitor that any pathway on this map that is as big as his little finger (about 1% of energy flow) represents a $30–100 billion annual opportunity.

Saul has used that analysis to help guide the choice of projects that his company, Otherlab, works on. Natural gas storage. Much cheaper ways of building large-scale solar arrays that more efficiently track the sun. Air-conditioning that uses half as much energy to heat or cool a room. Soft robots able to tackle the trillion-dollar market for combating corrosion in infrastructure and building, sanding and repainting airplanes and bridges at a fraction of today’s cost. Otherlab’s expertise is in cutting-edge materials science and the mathematics of structure and manufacturing. Where they apply that expertise is based on an analysis of the big problems that need solving this century in energy and climate change.

“If anyone thinks that nine billion people are going to live as well as two billion people do today without radical changes to the economy,” Saul said to me, “they must be crazy.”

Thinking about the conjoined long-term trends of global population growth, worldwide rise in living standards, and the energy intensity of modern civilization, it’s pretty clear that a huge part of our future is going to require a radical shift in the amount of energy we use per unit of consumption.

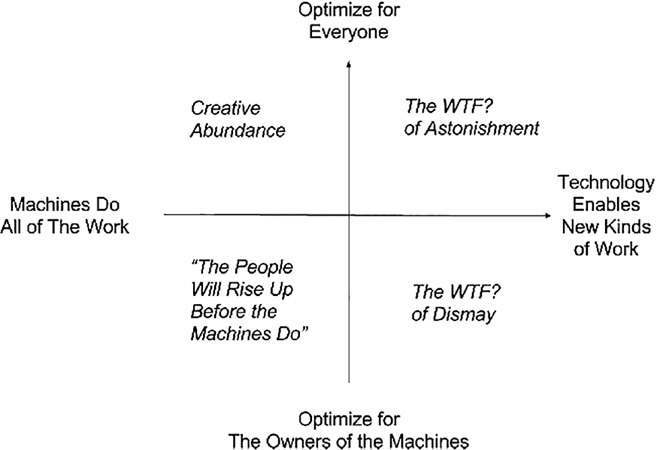

It is possible to construct a similar scenario grid for the questions of technology and the future of the economy that we have been exploring in this book.

Such a scenario grid might look something like this:

Let the first vector be the speed with which technology destroys jobs versus the speed with which it enables new kinds of work.

Let the second vector be the extent to which we use technology solely to optimize for the wealth of the owners of the machines, or to optimize for the wealth of all participants in the global economy.

Even if the machines do all of the work, and technology destroys jobs outright, we can build an economy of creative abundance if we use the fruits of machine productivity for the benefit of everyone. The challenges in the top left quadrant will be to knit a new social fabric where learning, creativity, and the human touch are valued very differently than they are today. We must craft policies that support, encourage, and reward the kinds of work that only humans can do for each other. Networked marketplace platforms can be a powerful tool in shaping this next economy.

On the top right, human beings are augmented to do things that were previously impossible. This is the WTF? of astonishment and delight, the future of bringing extinct species back to life or creating whole new ones, of extending human life spans and traveling to other planets, of eliminating disease, of engaging all of humanity in great challenges and fairly distributing the rewards of mastering those challenges.

In my optimistic moments, I think we can build a robust future across both of these quadrants.

In the lower two quadrants, though, we have the world we are heading pell-mell toward, at worst a world of revolution, social upheaval, and perhaps even warfare like we saw in the early days of the first industrial revolution, and at best, the WTF? of dismay, as technology births new wonders whose benefits are reserved for privileged elites while most of humanity barely gets by.

It doesn’t have to be that way.

Even when a dark future seems to be staring us in the face, though, we lack the courage to do what must be done. Despite our best efforts, most of the time we fail to respond to potentially catastrophic consequences of changes that are already well under way. And despite the lessons of history, we haven’t yet made the hard choices to fundamentally restructure our economy.

Instead, we argue over which of the failed recipes of the past we will try again. Political leaders and policy makers could learn a lot from Jeff Bezos.

In the employee Q&A at a March 2017 all-hands meeting at Amazon, where Jeff continues to remind his employees that “it’s still Day 1,” someone asked him, “What does Day 2 look like?” Jeff gave a passionate response, which he recounted in his annual shareholder letter a few weeks later: “Day 2 is stasis. Followed by irrelevance. Followed by excruciating, painful decline. Followed by death.” That is a dire prognosis for a company or a society, yet it is what we face if we accept the status quo or the WTF? of dismay.

Jeff continued with four tips for staving off Day 2: “customer obsession, a skeptical view of proxies, the eager adoption of external trends, and high-velocity decision making.” Customer obsession is the key to the WTF? of delight: “Even when they don’t yet know it,” Jeff wrote, “customers want something better, and your desire to delight customers will drive you to invent on their behalf.” Whether you’re in business or public policy, don’t settle for rehashing tired solutions. Keep looking for that positive astonishment that means you’ve accomplished something wonderful for the people you serve. Jeff continued: “Staying in Day 1 requires you to experiment patiently, accept failures, plant seeds, protect saplings, and double down when you see customer delight.”

Regarding “resisting proxies,” Jeff noted that one of the traps that leads to Day 2 is that “you stop looking at outcomes and just make sure you’re doing the process right.” We can’t just accept whatever results we get from following old rules; we must constantly measure our actions against their results. And when we see that the results don’t measure up to our dreams, we must rewrite the rules.

Jeff also urged his employees to embrace powerful trends in technology and the economy: “If you fight them, you’re probably fighting the future. Embrace them and you have a tailwind.” Artificial intelligence isn’t just for companies like Amazon, Google, and Facebook; like the Internet, open source software, and data science, it will transform every business and ultimately our entire society. Genetic engineering and neurotech are not far behind.

Jeff’s last point, about the speed of decision making, is the last ingredient for dealing effectively with the task of creating not just a better company but a better future. Jeff’s advice is priceless:

First, never use a one-size-fits-all decision-making process. Many decisions are reversible, two-way doors. Those decisions can use a light-weight process. For those, so what if you’re wrong? . . . Second, most decisions should probably be made with somewhere around 70% of the information you wish you had. If you wait for 90%, in most cases, you’re probably being slow. Plus, either way, you need to be good at quickly recognizing and correcting bad decisions. If you’re good at course correcting, being wrong may be less costly than you think, whereas being slow is going to be expensive for sure. Third, . . . If you have conviction on a particular direction even though there’s no consensus, it’s helpful to say, “Look, I know we disagree on this but will you gamble with me on it? Disagree and commit?”

The future is full of uncertainty. But our society is deep into Day 2, and the path we are on does indeed lead to stasis, irrelevance, and decline. Bold decision making; reversal of course when we find we are wrong; understanding of technological, demographic, and economic trends; and a relentless focus on making a better world for everyone can bring us renewal and the opportunity to rediscover Day 1 for our economy.

WORK, NOT JOBS

Even without doing a scenario-planning exercise, asking yourself “What happens if this goes on?” is a great way to prepare for the future—and to spot entrepreneurial opportunities.

Whether through observing positive trends like Moore’s Law or the decreasing cost of gene sequencing (which is accelerating even faster than Moore’s Law did), you can often anticipate the direction of new breakthroughs. You can also anticipate the negative disruptions that can result from failing to come to grips with a problem like income inequality or algorithms being perfected to faithfully fulfill the wrong fitness functions.

Entrepreneurship and invention require a kind of intellectual arbitrage, understanding the gap between what is possible and what has been accomplished so far.

It isn’t just in technology that you can apply this kind of thinking. One of my favorite moments during the Markle Foundation Rework America initiative was the talk by fellow task force member Mike McCloskey, the founder and CEO of Select Milk Producers, the sixth-largest dairy cooperative in the country, and of Indiana’s Fair Oaks Farms, his own dairy.

Mike looks a bit like the character Ron Swanson in the TV show Parks and Recreation, except bigger, and he talks like him too, slowly and with impact. “Some people would say we’re an agribusiness,” he said, “but I like to think we’re still a family farm. I work on the farm. My wife and kids work on the farm. And ten thousand other families live and work on our farms.”

Mike had been asked to talk about the importance of the agricultural sector to the economy, but he had much more to say than that. What he said was, to me, the most important statement of the multiyear exercise. “The way I see it, we have a job to do. There are going to be nine billion people in the world, and they are going to need protein. There are going to be three billion people in the middle class, and they are going to want better protein.”

Mike took a hard look at the world and the way things are going, and made a determination of what work needs doing. That should be the goal of every entrepreneur.

Mike’s comments struck me as so much more actionable than the hand-wringing we’d all been seeing about the decline of good middle-class jobs. While I agree with the urgency of that problem, Mike had put his finger on the answer. Not hoping that “the market” could somehow be incented to produce those good middle-class jobs again. “We have a job to do,” he said.

Not “we need jobs.” As Nick Hanauer also pointed out, there are two very different concepts tied up in that same word. The first, the one that Mike was using, is about the work that needs doing. The second, which pervades too many discussions of the economy, is a pallid, passive echo of the first, a job as something that you acquire from someone else, like you might find a product on the grocery shelf. If they are all gone, you’re out of luck. “Work,” not “jobs,” should be the organizing principle for our map of the future labor economy. There is plenty of work to be done.

IT’S UP TO US

At my 2015 Next:Economy Summit, an event I’d organized to explore the impact of technology on the future of work, Limor Fried, the founder and CEO of Adafruit, appeared via Skype, giving us a virtual tour of her factory and warehouse in New York City. She showed us the design workstation where she creates innovative electronic devices and kits; a few steps away were the pick-and-place machines for placing chips on the circuit boards she develops herself, as well as other small-scale manufacturing equipment. Forty feet away she showed us the video studio where she records her popular “Ask an Engineer” show as well as free online tutorials for how to do everything from circuit design to 3-D printing. Then we took a walk around her warehouse, taking a look at the more than $30 million worth of products and parts she sells each year to her enthusiastic online audience, and meeting some of her 100+ employees.

I remember when Limor, an MIT-trained engineer, and her husband, Phil Torrone, a creative genius who formerly worked in the ad industry but now helps to build Limor’s online presence, had their living quarters behind a curtain in her first small office. Limor built the business without venture capital, using credit cards to finance her original investments in office and inventory, and then bootstrapped her way up to success by creating products people really want, using the tools of modern media—YouTube, Twitch, email, and the web—to promote them. Championing open source hardware and engineering education, Limor had become a media star, gracing the cover of Wired magazine and being named a White House “Champion of Change” by President Obama. But perhaps the thing that makes her proudest is the mom who wrote in after watching “Ask an Engineer” with her daughter to tell Limor that the seven-year-old had asked, “Mom, can boys be engineers too?”

A year later, at the second Next:Economy Summit, we had another livestreamed presentation, this time from a cavernous hangar that had just been built in an open field in Rwanda. Keller Rinaudo, Zipline’s cofounder and CEO, had just concluded an event with the president of the country to celebrate the formal launch of the California-based company’s on-demand blood-delivery drones. Rwanda is a country with underdeveloped hospital infrastructure and often-impassable roads. Postpartum hemorrhage is one of the leading causes of death among women. It has never been possible to stock enough of the various blood types needed at remote clinics, but Keller and his cofounders have found a way to leapfrog over the lack of twentieth-century infrastructure and instead use the WTF? technologies of the twenty-first to solve a seemingly intractable problem. From only three drone airfields paired with blood storage facilities, the company can get blood to clinics anywhere in the country within fifteen minutes.

The company has raised $43 million in venture capital, with the latest round of $25 million intended to build distribution in other markets, including Vietnam, Indonesia, and, if regulatory barriers can be overcome, the United States. In the United States, services could mean delivering blood or medicine in rural areas, but it could also mean medical supplies for urgent needs, such as an Epi-Pen or snakebite antivenin on demand for an unexpected life-threatening emergency.

In the months in between the two events, I talked to hundreds of innovators, including many people whom you might not think of as entrepreneurs inventing the future. One of the most vivid and important meetings in shaping my thinking about a possible future for the economy was my nighttime walk around Central Park with social media sensation Brandon Stanton, creator of the Facebook feed Humans of New York. It was the only time he had to meet, while walking the dog, he said. He is too busy during the day.

Brandon is a photographer and storyteller. He searches, he told me, for people who look like they might have time to talk. His photographs, each accompanied by a paragraph with a key quote that captures the essence of his long conversation with the subject, have garnered his feed more than 25 million followers on Facebook and other social media platforms.

He originally started publishing his photos online in hopes that he could just make a living from doing what he loves. Unlike most people who have large social media followings, though, Brandon didn’t try to cash in via advertising. He has created two bestselling books from his photos and stories, and is a frequent speaker to businesses and at college commencements. But he reserves the direct power of his social media following to raise money for causes inspired by the people whose stories he tells.

Brandon didn’t set out to be an online fundraiser. His instinct for the importance of human connection led him to it. Vidal Chastanet, a thirteen-year-old from Brownsville, an area of Brooklyn with one of the highest crime rates in New York City, told Brandon that Nadia Lopez, the principal of his school, was the most inspiring person in his life. That led Brandon to a photo series on Mott Hall Bridges Academy. “Up until this moment, I didn’t know I mattered,” said Lopez. “I didn’t know that anybody cared what I was doing.” In her interview, Nadia confessed that one of her dreams was to take her students on a trip to Harvard, to remind them that anything could be possible for them. Brandon asked his followers (then 12 million) to chip in. He thought he might raise $30,000. Social media fans contributed $1.2 million.

A sad-looking woman sitting on a bench led him into the world of childhood cancer and a series on the families and the healthcare professionals who battle it. He ended up raising $3.8 million for research into the condition that took the life of that mother’s young son. And so on. Refugees. Veterans. Inmates. The homeless. Ordinary people of every race, religion, and age, no longer just in New York but around the world. Brandon plumbs their souls, tells their stories, and shows us their faces. And millions of us respond.

Limor, Keller, and Brandon illustrate why, despite the fears of those who say that the next wave of automation will put everyone out of work, we don’t have to run out of jobs. It isn’t technology that puts people out of work; it’s the decisions we make about how to apply it.

Limor has applied technology as a tool of creativity and teaching, bootstrapping her business by finding customers willing to pay for what she does; she has committed much of her time and effort to educating others about how she does her work both as an engineer and as an entrepreneur, so they can do it too.

Keller has used technology as a tool to solve a previously insoluble problem, using venture capital to build out the infrastructure of the future. If Zipline invents the new model for on-demand healthcare delivery, it won’t be because they set out to disrupt healthcare. It will be because they first solved the problem for people half the world away, people whom the last wave of prosperity had passed by.

Brandon has used technology to create and distribute humane works of enormous beauty and insight, and has wielded the power of his social media following to shed light on and to support causes that matter.

Almost everything we need to know about the future of work in a world where machines take away many of today’s jobs can be found in these three stories. Given a fair distribution of the fruits of machine productivity, people will entertain, educate, care for, and enrich each other’s lives. And given a focus on solving real human problems, people can invent amazing futures.

Entrepreneurs like Limor and Keller and Brandon give me hope because they would do what they do even in a world where machines had made all of the necessities of life so cheap that no one needed to work. There are millions—nay, billions—more people who can follow in their footsteps.

The great political eruptions of 2016 also give me hope because they signal the beginning of the end of a failed economic theory. In the cracks in our society that they have exploited, and so unmasked, we can see that it is time to renew ourselves.

This is my faith in humanity: that we can rise to great challenges. Moral choice, not intelligence or creativity, is our greatest asset. Things may get much worse before they get better. But we can choose instead to lift each other up, to build an economy where people matter, not just profit. We can dream big dreams and solve big problems. Instead of using technology to replace people, we can use it to augment them so they can do things that were previously impossible.

Get WTF?: What's the Future and Why It's Up to Us now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.