Module 11

Fixed Assets

Property, Plant, and Equipment

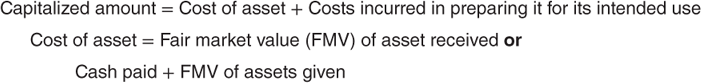

General Rule

Gifts:

| Asset (FMV) | xx |

| Income | xx |

Other capitalized costs for assets acquired by gift or purchase:

- Shipping

- Insurance during shipping

- Installation

- Testing

Land and Building

Total cost:

- Purchase price

- Delinquent taxes assumed

- Legal fees

- Title insurance

Allocation to land and building—Relative Fair Market Value Method

Land = FMV of land ÷ Total FMV × Total cost

Building = FMV of building ÷ Total FMV × Total cost

Capitalization of Interest

Capitalize on:

- Assets constructed for company's use

- Assets manufactured for resale resulting from special order

Do not capitalize on:

- Inventory manufactured in the ordinary course of business

Interest capitalized:

- Interest on debt incurred for construction of asset

Interest on other debt that could be avoided by repayment of debt

Computed on:

- Weighted-average accumulated expenditures

Costs Incurred After Acquisition

Capitalize if:

- Bigger—The cost makes the asset bigger, such as an addition to a building

- Better—The cost makes the asset better, such as an improvement that makes an asset perform more efficiently

- Longer—The cost makes the asset last longer, extends the useful life

Do not capitalize:

- Repairs and maintenance

Depreciation and Depletion ...

Get Wiley CPAexcel Exam Review 2015 Focus Notes: Financial Accounting and Reporting now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.