Module 1

Professional Responsibilities

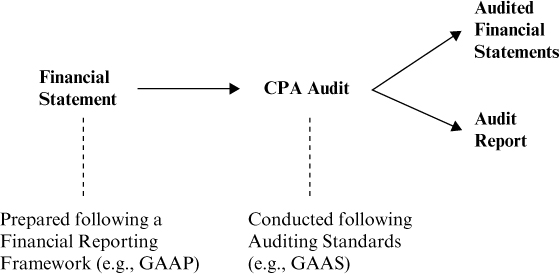

Financial Statements, an Audit and Audited Financial Statements

Principles Underlying an Audit

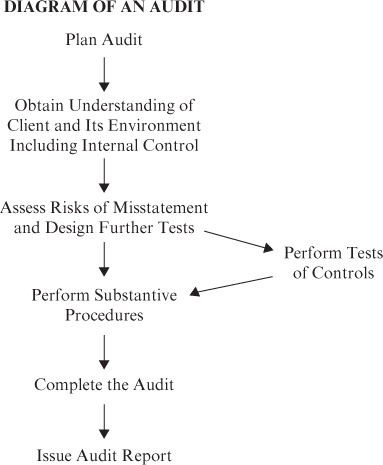

- Purpose of audit—Provide an opinion.

- Premise of audit—Management has responsibility for preparing financial statements and providing auditor with all needed information.

- Personal responsibilities of auditor—Competence, follow ethical requirements, maintain professional skepticism.

- Auditor actions in audit—Provide procedures to obtain reasonable assurance about whether financial statements are free from material misstatements.

- Reporting results of an audit—Written report with an opinion, or a statement that an opinion cannot be obtained.

Auditing Standard Requirement Categories

- Unconditional requirement—The auditor must comply with the requirement in all cases in which the circumstances exist. SAS use the words must or is required to indicate an unconditional requirement.

- Presumptively mandatory requirement—Similarly, the auditor must comply with the requirement, but, in rare circumstances, the auditor may depart from such a requirement. In such circumstances, the auditor documents the departure, the justification for the departure, and how the alternative procedures performed in the circumstances were sufficient. SAS use the word should ...

Get Wiley CPAexcel Exam Review 2015 Focus Notes: Auditing and Attestation now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.