Module 46: Cost Measurement and Assignment

Cost Measurement and Assignment

Cost Classifications

Product and Period Costs

| Product | Period |

| Direct materials (DM) | x |

| Direct labor (DL) | x |

| Manufacturing overhead (MOH) | x |

| Selling, general, and administrative expenses (SG&A) | x |

Prime and Conversion Costs

| Prime | Conversion | |

| DM | x | |

| DL | x | x |

| MOH | x |

Variable and Fixed Costs

| Variable | Fixed | |

| DM | x | |

| DL | x | |

| MOH | x | x |

| SG&A | x | x |

Costing Methods

Manufacturing Overhead

- Calculate the predetermined overhead rate (POHR)

Estimated variable MOH for period + Estimated fixed MOH for period = Estimated total MOH for period ÷ Estimated # of units for period (cost driver) = Predetermined overhead rate (POHR)—often split into fixed and variable rates - 2. Apply MOH to WIP

Actual # of units for period (cost driver) × POHR = MOH Applied - 3. Determine under-applied or over-applied MOH

- Actual MOH > MOH applied: MOH under-applied

- Actual MOH < MOH applied: MOH over-applied

- Dispose of under-applied or over-applied MOH

- Generally added to or deducted from cost of good sold (COGS)

- May be charged or credited directly to income

- May be allocated to WIP, finished goods, and COGS

Job Order Costing

Used when units are relatively expensive and costs can be identified to units or batches

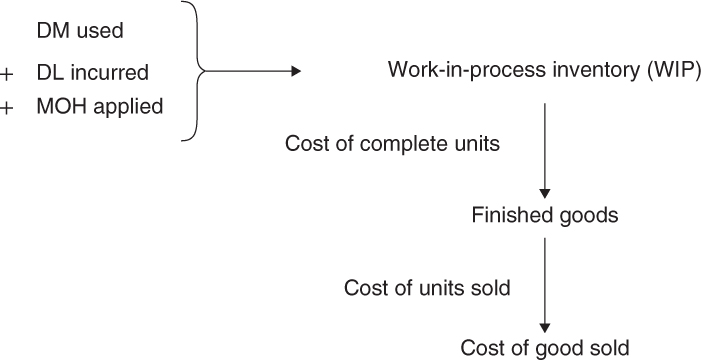

- DM, DL, and MOH applied charged to WIP

- Cost of completed units removed ...

Get Wiley CPAexcel Exam Review 2015 Focus Notes: Business Environment and Concepts now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.