Focus on: Monetary Assets and Liabilities—Module 12

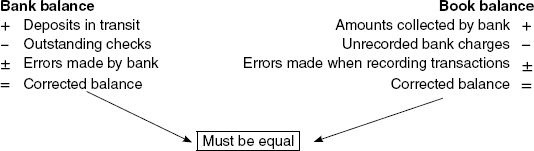

Bank Reconciliation

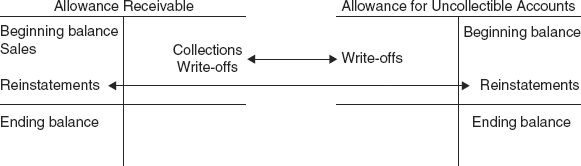

Accounts Receivable

Net realizable value = Accounts receivable – Allowance for Uncollectible Accounts

Uncollectible Accounts

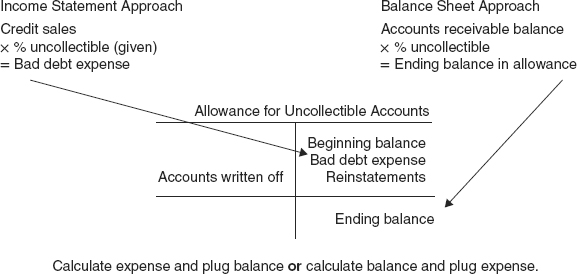

Allowance Methods—GAAP

Direct Write-off Method—Non-GAAP

Notes Received for Cash

Calculating Payment

Principal amount ÷ Present value factor = Payment amount

Allocating Payments

Payment amount – Interest = Principal reduction

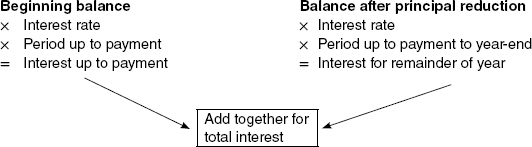

Calculating Interest

Notes Received for Goods or Services

Note Balance

Short term: Amount = Face value

Long term: Amount = Fair value of goods or services

Present value of payments if fair value not known

Journal entry:

| Note receivable—Face amount (given) | xxx |

Revenue—Calculated amount |

xxx |

Discount on note receivable ... |

Get Wiley CPAexcel Exam Review 2014 Focus Notes: Financial Accounting and Reporting now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.