Income Taxation

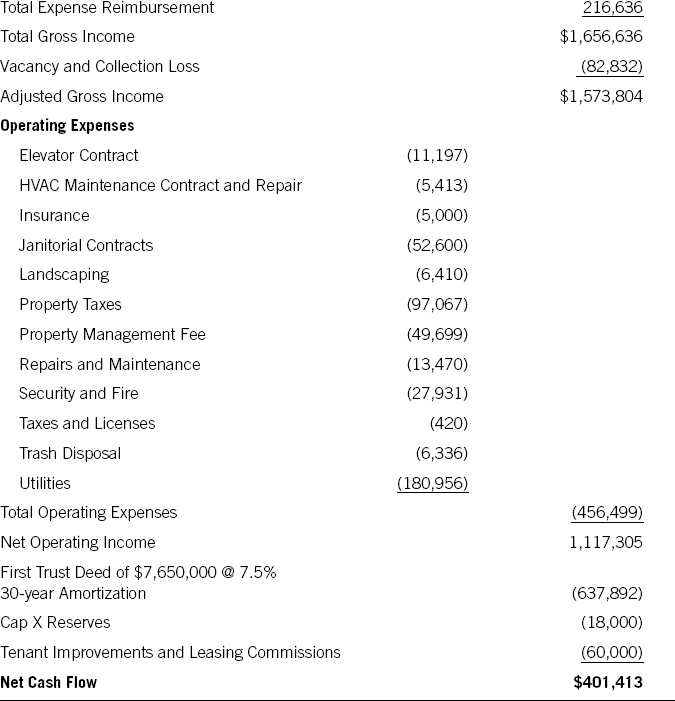

While you own and operate real property, taxes must be paid on the income that you earn in doing so. Let us take another look at our hypothetical model, the Diamond Medical Center. Again, let us assume Diamond Jack purchased the medical office building for $10,200,000 with $2,550,000 down (25 percent) and a $7,650,000 first trust deed (75 percent) at 7.5 percent interest-only for the first three years, then a 30-year amortization. The first year's operating results were as follows:

Is the income tax a percentage of the Net Operating Income, of the Cash Flow Before Debt Service but after Reserves, or of the Net Cash Flow figure? The answer is that it is not a percentage of any of these figures. The income tax is a tax imposed on the net profits or losses from the annual operations of the property. Adjustments must be made to the above categories to derive Net Taxable Income.

Net Operating Income does not equal Net Taxable Income because NOI must still be reduced by depreciation and interest expense as well as by a percentage of capital expenditures, tenant improvements, and leasing commissions. Depreciation is a noncash deduction; it is not an operating expense. However, for tax purposes, depreciation is a reduction to gross income.

Cash Flow Before Debt Service ...

Get Wealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment Properties now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.