Operating Expenses

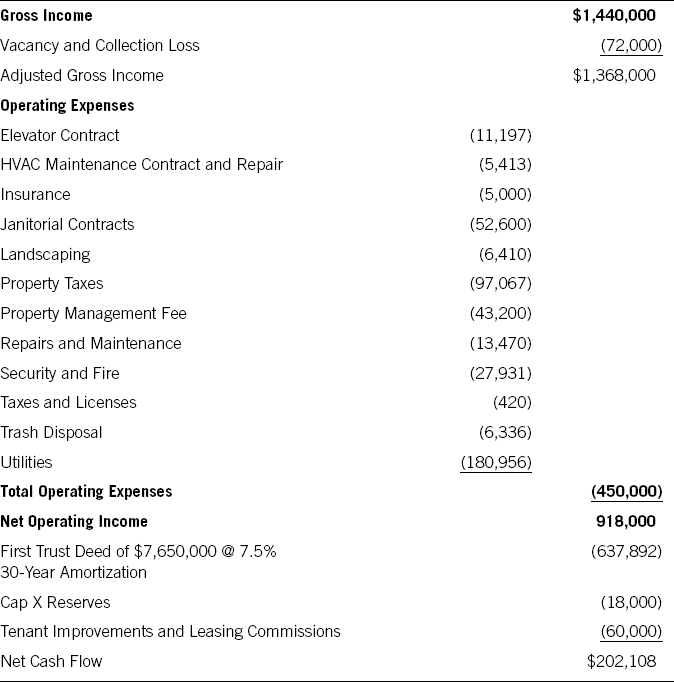

Operating expenses include all of the costs associated with running the property. Using the analysis developed in the prior chapter and adding specific operating cost line items, the chart might look as follows:

The following observations serve to clarify some of the operating expense line items.

Real property taxes are being shown as actual current charges. In California, Proposition 13 and Proposition 8 have significantly affected property taxation. Under Proposition 13, the annual real estate tax is limited to 1 percent of its assessed value. The “assessed value” may be increased only by a maximum of 2 percent per year, except if the property undergoes a change in ownership, or new construction occurs. At the time of the change in ownership, the assessed value may be reassessed to the full current market value which most likely will result in a new base year value for the property. Similarly, if the property is improved, the value of the improvements would be added to derive a new base year value. Future assessments, however, are restricted to the 2 percent annual maximum increase on the new base year value. Proposition 8 amended Proposition 13 to provide for a reduction in the assessed value if the market value of the property declines below its assessed value.

In our hypothetical scenario, if real property taxes were brought to market due to a sale at $10,200,000 ...

Get Wealth Opportunities in Commercial Real Estate: Management, Financing, and Marketing of Investment Properties now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.