DEFINING THE VALUATION PROBLEM

When trying to decide what valuation approach to use in a particular situation, it is important to begin by defining the objective of the analysis. In other words, it is important to accurately define the valuation problem. Three things are particularly important to consider in this context: the claim and level of value, the valuation date, and the purpose/definition of value. This process of defining the valuation problem often leads the analyst to the appropriate methodology.

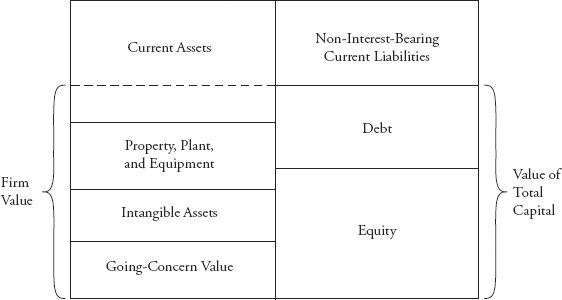

To understand the concept of defining the claim, consider the finance balance sheet. All analysts are familiar with the accounting balance sheet, where book value of assets equals the book value of liabilities plus shareholders’ equity. The finance balance sheet is similar except that it is forward looking and based on market values rather than book values. A graphical illustration is shown in Figure 13.1. On the left side is the value of the assets in the business. The value of the assets must equal the value of the claims on those assets; someone owns the assets, so the values have to be equal. Another way to think about this is that the present value of the cash flows from the business is on the left side and the values of the claims on those cash flows are on the right side.

FIGURE 13.1 Finance (Market Value) Balance Sheet

The first step the analyst should take is to ask ...

Get Valuation Techniques: Discounted Cash Flow, Earnings Quality, Measures of Value Added, and Real Options now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.