FEVA

We can now propose a corporate valuation formula that consistently reconciles the different value drivers contained in the traditional valuation models. The analysis of the example based on Table 11.1 data indicates that two approaches to corporate valuation are possible:

- methods that follow the MM logic and show how the financial policy adds value to the company through decisions about financial structure and

- methods that follow the EVA logic and show how the economic policy adds value to the company through investment decisions.

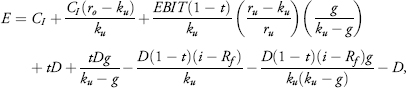

Our financial and economic value added formula attempts to combine both approaches. Although it does not differ essentially from current formulas, it carefully differentiates the corporate value drivers, at the economic and financial level, while respecting the principle of one value. Accordingly, it can provide a complete picture of how corporate value is generated. The FEVA model is as follows:

where

CI = initial cash or capital invested

ro = [EBIT(1 − t)]/CI = the return on capital invested

ru = [g(EBIT)(1 − t)]/I

According to the FEVA model, eight value drivers explain the market value of equity. Three of the drivers are economic in nature, and five are financial. The economic drivers are as follows:

Get Valuation Techniques: Discounted Cash Flow, Earnings Quality, Measures of Value Added, and Real Options now with the O’Reilly learning platform.

O’Reilly members experience books, live events, courses curated by job role, and more from O’Reilly and nearly 200 top publishers.